Regarding a profitable financial application, you can find circumstances a loan provider usually takes under consideration, including your money, discounts, jobs balances and you can ages. Another significant basis will be your credit history, that is encapsulated on your own credit history. Your credit rating may have an impact on your opportunity off acceptance, interest and you can put necessary.

Insights their rating is essential if you are searching discover a home loan or refinance a current financial and you may attempting to replace your danger of recognition, it might help you negotiate a much better speed.

Exactly how are my personal financial application assessed?

The borrowed funds acceptance standards to own home financing commonly disagree anywhere between each mortgage financial, nevertheless they will likely make after the into consideration:

- Your existing cash. For example such things as your existing earnings, expenses models, any deals you really have plus power to repay the borrowed funds.

- The borrowing record. The truth is, it is not fundamentally an adverse material if you have lent much. Additionally very important was their repayment habits. If you possibly could let you know you paid down borrowing consistently and therefore you can easily have the ability to pay the loan amount, your enhance your chances of a profitable home loan app.

- Your job records. Lenders will require into consideration how many times you’ve got altered work and affairs such as for instance job safeguards and you can balance.

- Your own Discounts. Loan providers makes it possible to figure out how far you could obtain in accordance with the matter you have spared. In accordance with the kind of property you really can afford, you could make a knowledgeable choice towards the whether you are able getting a purchase today, or should rescue much more otherwise adjust your own requirement.

What’s the lowest credit rating wanted to get home financing?

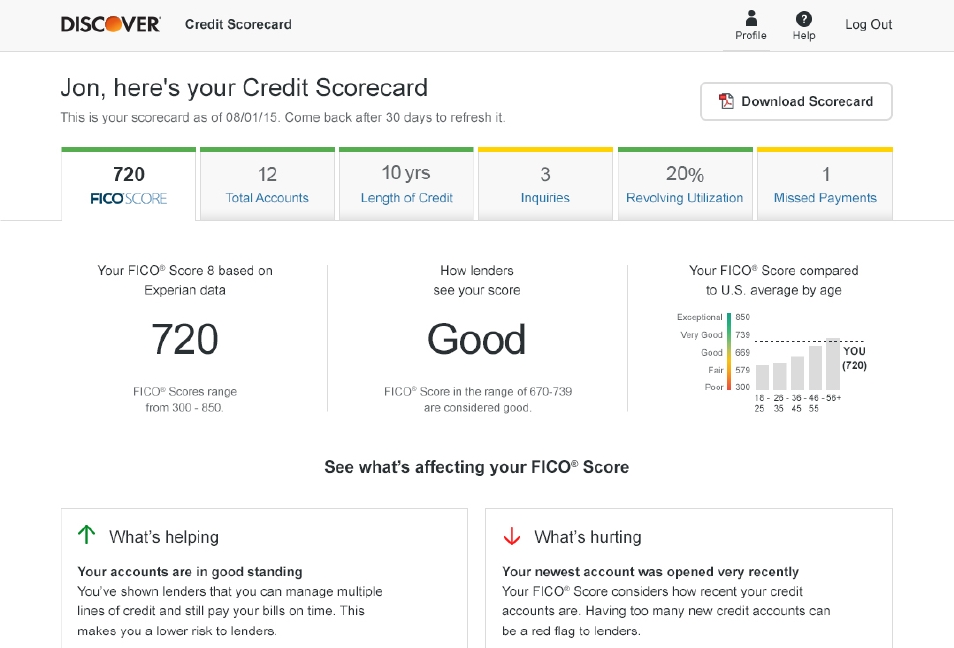

It’s hard to state exactly what with people confidence exactly what minimum borrowing from the bank get is required to score a home loan in australia, because most loan providers usually do not upload its borrowing criteria. Because of this, the financing get you’ll need for home financing may differ founded to the Brighton bad credit payday loans no credit check open 24/7 who you apply at. Lenders explore different algorithms so you can assess regardless if you are qualified to receive a loan. But not, as the a harsh publication, glance at these types of benchmarks, reliant an enthusiastic Experian get following check your very own credit get right here to determine the place you sit.

- Lower than 625. If the rating drops below 625, you may not possess a high sufficient credit score so you can qualify getting a home loan. Many people that have a credit score off lower than 625 would likely need to look to possess a personal bank loan from the second level lender.

- 625 to 699. You probably involve some disadvantages on your credit rating, your current earnings and financial situation are seemingly fit. Mortgage brokers could see you as actually an elevated chance, so you could have trouble finding home financing that have the lowest interest rate and can even have to possess a bigger deposit. Looking for a keen unsecured personal loan out-of a primary tier financial will get additionally be more challenging.

- 700 to help you 799. When you’re you will probably do not have material protecting a personal loan, you might have to rescue a more impressive put while you are taking right out home financing having one of the ‘Big 4’ loan providers.

- 800-899. You happen to be basically considered to be creditworthy, for example extremely lenders could be safe considering the application.

- 900-1,100000. You are considered a some really good borrower, which makes it easier to acquire acceptance.

Is it possible you get a mortgage having a bad or average credit history?

Very do you really qualify for a mortgage having less than perfect credit? Just because you might not provides a credit score to help you meet the requirements to possess home financing with particular loan providers does not mean you never have solutions. Just what it probably means is the fact you will be only qualified to receive specific home loans, that’ll will often have high rates.

Discover lenders around australia whom specialize in home financing issues available for individuals with smaller tempting fico scores. If you like a much better interest than the you to you may be currently being offered, commonly it just takes a couple of years regarding saving, expenses smartly and you can constantly paying down on time.

Exactly what are low-conforming lenders?

Non-conforming lenders are some of the options available in order to consumers with a significantly less than excellent credit history. They are an alternate types of mortgage accessible to individuals just who cannot meet the fundamental credit requirements lay out of the big family loan lenders and you can finance companies. In the event the everything has went wrong for your requirements in the past with money, non-conforming lenders would-be a viable alternative to get anything straight back focused.

The catch is the fact rates of interest are often large. This is so loan providers can compensate on their own on the exposure it grab delivering a loan to people with very poor credit history. You can fully plan to shell out your house mortgage, nonetheless cannot yet know that.

The good news is if your continuously see the loan costs, you can change your credit rating. Down the line, you will be capable re-finance so you’re able to a less costly home loan.

Approaches for increasing your approval possibility

Otherwise meet up with the minimum requirements to have a mortgage around australia, there are activities to do to switch your credit rating and fix your financial situation.

What ought i do if my home loan app becomes denied?

In case the financial app might have been refuted, it’s not the conclusion the nation. You will find, although not, several things you ought to and you will ought not to do for the time being: