If not qualify for Virtual assistant or USDA no down-payment home loans, there are other actions you are able to to minimize this new off commission you may be expected to pay. You can even search let thanks to individuals down-payment guidelines applications or away from a loved one.

FHA fund

They make it down repayments as little as step three.5% and have shorter strict credit standards, causing them to a good option for basic-date homebuyers or people with rugged borrowing from the bank histories.

These types of mortgages incorporate one another an upfront mortgage premium out of step 1.75%, plus an annual superior one to means between 0.45% and 1.05% of your own amount borrowed.

Conforming money

Mortgage loans one comply with Federal Houses Finance Institution loan limits and you may the factors place from the Federal national mortgage association and you may Freddie Mac computer is known just like the conforming money. With one of these mortgages, one may purchase property with just 3% off.

To qualify, you may have to feel an initial-time homebuyer or fulfill income limits for your town. Conforming financing require also a credit score with a minimum of 620 and, if you make a downpayment from below 20%, your I).

Lender-certain financing applications

These types of are different commonly, so make sure you research rates and you can examine several options when the that is anything you’re looking for. You can look to banks, borrowing from the bank unions, mortgage enterprises, an internet-based loan providers getting options.

First-big date homebuyer gives and guidance software

Cities, condition houses enterprises, and you can local nonprofits possibly provide advice programs which can help you protection the costs of your down-payment or closing costs.

These may come into the form of gives, and that don’t need to end up being paid back, or lowest-appeal funds, which you can slowly pay-off throughout the years. In some cases, this type of loans can be forgivable if you reside in the home to own a specific period of time.

Preparing for the applying techniques

To ensure you be eligible for a zero down-payment mortgage, work on getting the credit rating from inside the an excellent put. When it is underneath the 620 to 640 draw, you might reduce the money you owe, dispute errors on your credit report, or request a personal line of credit improve to switch their rating. Purchasing their expense punctually support, as well.

Its also wise to lower your personal debt-to-money proportion – or the display of earnings the full month-to-month debt costs take-up. This is going to make your much safer to help you lenders (you have a lot fewer obligations and will be more likely to build your costs) that can make it easier to meet the requirements.

Eventually, collect enhance financial records, together with your W-2s, pay stubs, lender statements, and past taxation statements. The lender will require these to know very well what you might meet the requirements getting.

Though you won’t need a deposit with USDA and you may Va funds, they won’t become at no cost. Each other money wanted initial fees (financial support charge having Va finance and you may ensure fees to own USDA funds). This type of try to be financial insurance and you will manage your lender for those who usually do not help make your repayments.

You might rating a high rate of interest whenever forgoing a beneficial downpayment. This may raise one another the payment and your much time-identity notice can cost you somewhat. Make certain you have modified your finances for those extra will set you back when going for one of those fund.

Frequently asked questions

Sure, particular government-backed home loan apps succeed eligible individuals to get a home loan without a down-payment, although other can cost you such as closing costs and higher interest rates s which need tiny off repayments (only step 3%, in some instances).

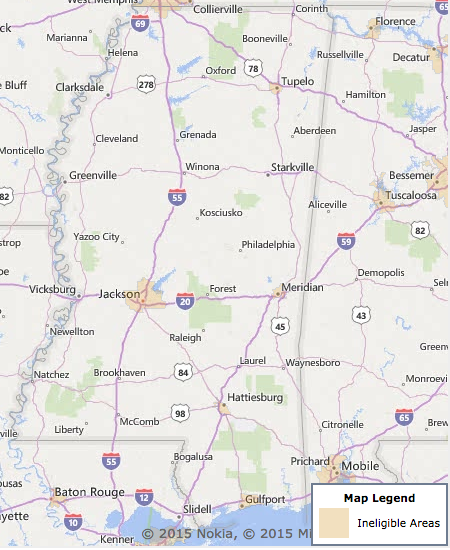

Virtual assistant and you can USDA funds may be the chief no downpayment alternatives in america. The new Va financing program is only to possess military pros, active solution players, and select spouses, while the USDA loan program is for include in particular rural and you will residential district components loans Otis CO.