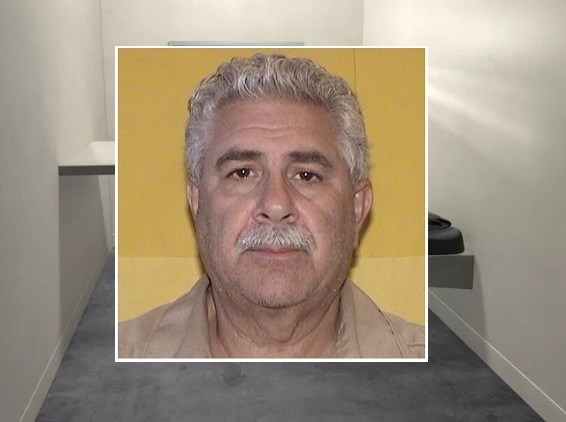

At the Hasley Residential property, we realize the importance of obvious and precise recommendations if it comes to homeownership. Provided of the Jake Meottel, good You Armed forces Seasoned having comprehensive knowledge of home spending, our commitment is always to foster believe and provide beneficial skills to own our very own community. An area where we often find misunderstandings has been Va house finance. Why don’t we place the fresh new checklist upright and give you the information you desire.

Virtual assistant Financial Mythology Debunked:

Navigating the world of Va home loans will be daunting, specifically with so many myths and you will misconceptions dispersing. Let us address several of the most common myths to help you finest understand the advantages and you will insights of Virtual assistant financing.

Myth 1: You could potentially Just use a Va Mortgage Once

Untrue. Probably one of the most preferred mythology is the fact Virtual assistant fund can also be just be utilized immediately after. Indeed, you should use an excellent Va loan several times. As well, you can have more than one Va financing unlock during the the same time frame. When you have paid a past Va loan or if perhaps your promote property purchased having good Virtual assistant mortgage, you can heal your entitlement and use it once more for another house.

Myth dos: You prefer Perfect Borrowing

Not true. Yet another extensive myth would be the fact a perfect credit history needs to own an excellent Va financing. The Virtual assistant by itself doesn’t put at least credit history criteria. While many loan providers choose a score of at least 620, it is really not a set code. New VA’s self-reliance is made to let far more pros be eligible for home loans, even when the credit actually pristine.

Misconception 3: Virtual assistant Finance Don’t Close That often

False. Virtual assistant funds features a track record if you are difficult to intimate, however, this is not appropriate. In fact, Virtual assistant finance has actually a high closing rate versus conventional and you may FHA money. The brand new VA’s be certain that will bring lenders with increased defense, making it easier to enable them to approve and you can process such fund.

Myth 4: Virtual assistant Finance Have Unanticipated Out-of-Pouch Will cost you

Not true. Of several accept that Virtual assistant funds feature invisible will cost you, but that isn’t genuine. Virtual assistant fund often incorporate no individual home loan insurance (PMI) and require zero advance payment, that will help eliminate aside-of-pouch expenses. The expenses with the Virtual assistant loans are generally quick and you can clear.

Misconception 5: Va Loans Possess A lot of Government Red tape

Untrue. When you find yourself Va loans is backed by the government, they don’t come with a lot of red tape. Extremely Virtual assistant money try underwritten automatically, missing the need for detailed government acceptance. It streamlined procedure assists expedite mortgage acceptance and you can Midfield loans closure.

Additional information on Va Lenders

Navigating Va home loans can seem complex, but knowing the criteria and you may processes causes it to be smoother. Right here, i break down the requirements so you can on the travel to help you homeownership.

Should i Score Virtual assistant Mortgage getting an additional Home?

You may be capable heal their Va entitlement to make use of for purchasing another type of house, considering specific standards try came across. This really is instance useful when you are moving in otherwise to buy an excellent 2nd household to possess financial support motives.

Which are the Criteria to own Virtual assistant Home loan?

To locate a Virtual assistant mortgage, you prefer a certificate off Eligibility (COE). That it certification proves their qualifications based on service standards. If you don’t meet the lowest services conditions, there could be alternative an effective way to qualify, such as for example as a consequence of launch reasons and other special things.

What’s the Va Mortgage Process?

The procedure so you can consult a good COE concerns implementing on the web or due to the bank. If not meet with the important solution standards, you might still be considered centered on unique issues otherwise a release improve.

Is it possible you Let me know More about Virtual assistant Home loan Eligibility?

Eligibility to have a beneficial Virtual assistant home loan utilizes provider records and you can obligations position. This may involve experts, productive obligations service users, reservists, federal shield participants, enduring partners, and you can certain You.S. people whom served throughout the WWII. Societal Fitness Services officials, cadets on services academies, and you can officers of Federal Oceanic and you can Atmospheric Administration and additionally be considered.

Do Virtual assistant mortgage foreclosures forgiveness can be found?

As the Va does not bring outright foreclosure forgiveness, it can render guidelines apps to help pros end foreclosure. The latest VA’s Home loan Program is sold with choices like loan modification, fees agreements, and you can forbearance to greatly help residents that battling. Simultaneously, the fresh Virtual assistant will help that have refinancing choices to create repayments a lot more in check and you can work with lenders to get solutions to stop foreclosures.

Which are the credit score conditions to possess a great Va home loan?

Brand new Va by itself doesn’t place a minimum credit score needs having Virtual assistant mortgage brokers. Yet not, most loan providers possess their own credit history conditions. Usually, loan providers get a hold of a credit rating around 620 or higher. It is essential to discuss with individual lenders because of their particular criteria, while they can differ.

Exactly what are the advantages of a great Va financial?

- No Deposit: Virtual assistant finance will need no down payment, while making homeownership more obtainable.

- Zero Personal Financial Insurance policies (PMI): In the place of old-fashioned funds, Virtual assistant money not one of them PMI, reducing monthly installments.

- Aggressive Rates of interest: Va finance always come with down interest rates as compared to antique loans.

- Flexible Borrowing from the bank Conditions: Va funds bring a great deal more versatile credit score standards, permitting a whole lot more veterans be considered.

- Advice Software: The brand new Virtual assistant will bring tips and you can direction just in case you deal with monetary problems, assisting to avoid property foreclosure and you will do payments.

Who is eligible for a Va loan?

Qualification to have good Virtual assistant financial utilizes services background and obligations position. This can include veterans, active obligations provider members, reservists, national guard people, enduring partners, and you may specific You.S. customers which offered throughout the WWII. Societal Fitness Services officials, cadets on provider academies, and you can officials of the National Oceanic and you may Atmospheric Government along with qualify.

As to why Hasley House Cares (And exactly how We are able to Help)

In the Hasley House, led because of the Jake Meottel, we have been seriously interested in supporting our very own people and you may bringing reliable real home options. The commitment to cultivating trust and you will dealing with most of the visitors relating is actually rooted in Jake’s thorough feel and you may armed forces record. We know the unique pressures veterans deal with and are usually right here in order to show you from the Va financial process which have openness and you will sympathy.

Whether you are examining the options to possess good Virtual assistant financial, need assistance with repairing your entitlement, or basically trying to advice on our home to purchase processes, Hasley Homes has arrived to aid. The goal is always to be sure you have the advice and you may service you ought to build informed s.If you have any queries otherwise you want then guidance, don’t hesitate to touch base. We’re right here to offer the information and you may give you support have earned.