Save yourself articles to have afterwards

I’m 59 yrs old and you may my hubby are 58. The two of us intend on operating up until we are 67 and 63 correspondingly. You will find recently transferred to a smaller sized possessions value $1.5 million but still owe $fifty,000 inside it. It might be our permanently family. I’ve few other actual-house property. My hubby possess $450,000 during the extremely, and i also has $380,000 payday loans bad credit Dayville. He earns $140,000 per year and i also secure $120,000 a-year.

We would like to alive a smooth old age exactly what can i do to make certain we can take action? I’m not financially experienced I don’t have any idea how superannuation works! Do you identify what things to me personally in a very very first way, delight?

Extremely is going to be a complicated beast, however, wisdom actually somewhat later on in daily life produces a change. Credit: Simon Letch

You are on suitable song, but you have to do a funds to work through exactly how much do you consider possible purchase when you retire, immediately after which get advice for how much superannuation you will want to reach one to objective.

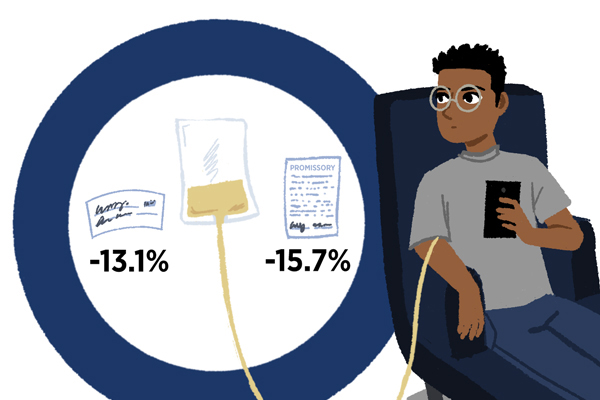

A bad aspect to possess awesome will be loss of accessibility up until you are free to 60 and prevent doing work in a position, but offered the ages which is less of problems for you. The wonderful thing about extremely is that you could generate benefits out of pre-tax bucks and you can when you retire all the withdrawals is actually taxation-free.

Noel Whittaker

The maximum deductible sum tends to be $31,000 annually but this can include the newest 11.5 % workplace share. The fresh employer might be installing $sixteen,100 per year for your partner and you will $13,800 per year to you personally.

This permits you area and then make tax-allowable efforts away from $thirteen,900 and you will $sixteen,2 hundred correspondingly, or even more if you have unused sum cap space out-of previous economic age. You might repeat this if you don’t is actually 67. Should you choose you to definitely I know your retirement goals could be realised.

I am 60 and you may owe $350,000 to my mortgage. My goal is to rating $250,000 on the purchases of my parents’ possessions. Was basically putting up whether I should shell out $250,000 off of the mortgage otherwise lay those funds for the awesome. I hope so you’re able to retire late the coming year.

Considering the seemingly brief timeframe up to retirement the difference inside the the speed becoming recharged on the home loan that’s particular, and the output from your own super fund being some unclear, In my opinion your best path is to try to afford the currency out of the house mortgage that ought to reduce the harmony to $100,000.

For the past fifteen weeks of the a career, be sure to place the limitation deductible into the super and use that and most other the investment possible to settle your house financing. A primary objective for most people is to try to retire personal debt free.

I’m 59 my work income is focused on $20,000 per year and my personal funding income means $120,000 per year. My personal extremely balance is $900,000. My mother would like to give us a young bucks heredity. The total amount in my situation are $250,000. Can i get their to get so it currency in to my superannuation financing otherwise can i receive the currency towards the my membership first and then join awesome?

The best method would-be to suit your mommy to convey the bucks directly, and after that you dribble it for the very during the rate out of an income tax-allowable $30,000 per year including one boss share. Additionally, you could potentially reinvest the fresh tax reimburse the sum do would by the also putting you to to the super as the a low-concessional sum.

My spouse and i possess pensions having reversionary nominations from inside the favour of each and every almost every other. Once certainly one of you dies, (a) the survivor are certain to get a couple pension streams up to their demise and you can (b) the survivor will have to nominate a joining death recipient to own both those people your retirement profile to displace the earlier reversionary pension nominations. Keeps I experienced one to best? Balances go for about $1.54 mil each and we are near the limitation import equilibrium caps.

With the a related point, specific element of both your retirement membership the fresh new survivor will provides would-be taxable on survivor’s passing until he has got taken particular otherwise almost everything in advance of their demise. Possess I got you to definitely proper?

You’re on ideal track. The fresh survivor can take over the reversionary pension considering their leftover transfer balance cap place is also fit their balance.

Or even, providing suggestions so you can rightly reconstitute inside one year regarding demise commonly be important to stop too much cap affairs. This new passing benefit nominations should be applied.

Towards survivor’s passing, one nonexempt role remaining in retirement benefits might be taxed getting beneficiaries for example low-depending mature students.

Once more, taking guidance today which have a view to make usage of actions particularly cashing out and recontributing section of their super stability while one another of you try alive (if around ages 75) normally minimise the new taxable parts and properly, the new demise taxation payable later on.

- Pointers given on this page is general in nature in fact it is perhaps not designed to influence readers’ behavior regarding expenses otherwise financial products. They must usually find their expert advice which takes for the account their particular individual facts prior to people economic conclusion.

Expert tips about how to conserve, purchase and make more of your money taken to your own email all the Week-end. Create our Real cash newsletter.