Post realization

- Research your facts ahead of ily user.

- See all of the cost ramifications from mobile a home to a member of family in place of bequeathing it.

- If there’s home financing linked to the assets your should current, the bond must be terminated and another you to definitely used having of the the fresh manager.

You can find standard advantages for those thinking about animated their residence on their nearest and dearest in lieu of bequeathing they in it immediately after its passing, but discover legal, tax and cost ramifications to take on.

The import from assets anywhere between family relations from inside the Southern area Africa: Precisely what does it include?

The brand new transfer of the home can often be in the way of a contribution (a present) or the selling of the home with the child. A created bargain must be inserted towards involving the moms and dad and youngster, or family unit members.

Will it be a much better option income tax-smart to current assets so you’re able to a family member rather than give it? SARS treats merchandise or contributions in a different way to bequests/ inheritances, but there are even legal or other costs factors on it.

Next additional can cost you shall be meticulously thought, and also the pointers from an expert gotten, because these costs could be paid-in the new short-term (when the donation is made) as opposed to are bequeathed up on a person’s demise.

Donations tax

If your property is donated on youngster otherwise family member, donations income tax away from 20% try payable by moms and dad or donor so you can SARS on the value of the house or property.

Anyone are eligible to an annual exemption out-of R100,000 according off contributions income tax. The initial R100,000 of one’s worth of the property tend to hence getting exempt from donations income tax additionally the harmony usually interest contributions income tax. That will be a high prices sustained regarding small-title.

Estate obligation

These income tax implications shall be very carefully compared to the property obligation effects in case the possessions is going to be bequeathed toward child or relative (as opposed to contributed).

To the passing, since possessions wasn’t contributed, the house or property would-be an asset regarding the deceased’s home. According to estate’s value (including taking into account the newest discount quantity of R3,five hundred,000 Budget that’s tax free), you’ll have house obligation…

Adequate bucks should be available on deceased’s house so you’re able to safety the new transfer will cost you. Property believe recommendations shall be gotten. You’ve got executor’s costs on property value the house or property.

Import obligations

Bequests out of immovable property try exempt regarding import obligation. Having said that, should your property is moved in longevity of the brand new moms and dad, the child which acquires the house or property will be liable for transfer obligations to the value of the property a lot more than R1,000,000 ( Budget).

SARS needs a couple separate valuations of the house if your events so you can a transaction are associated. In the case of both the donation and you will bequest, transfer fees might be payable with the move attorney.

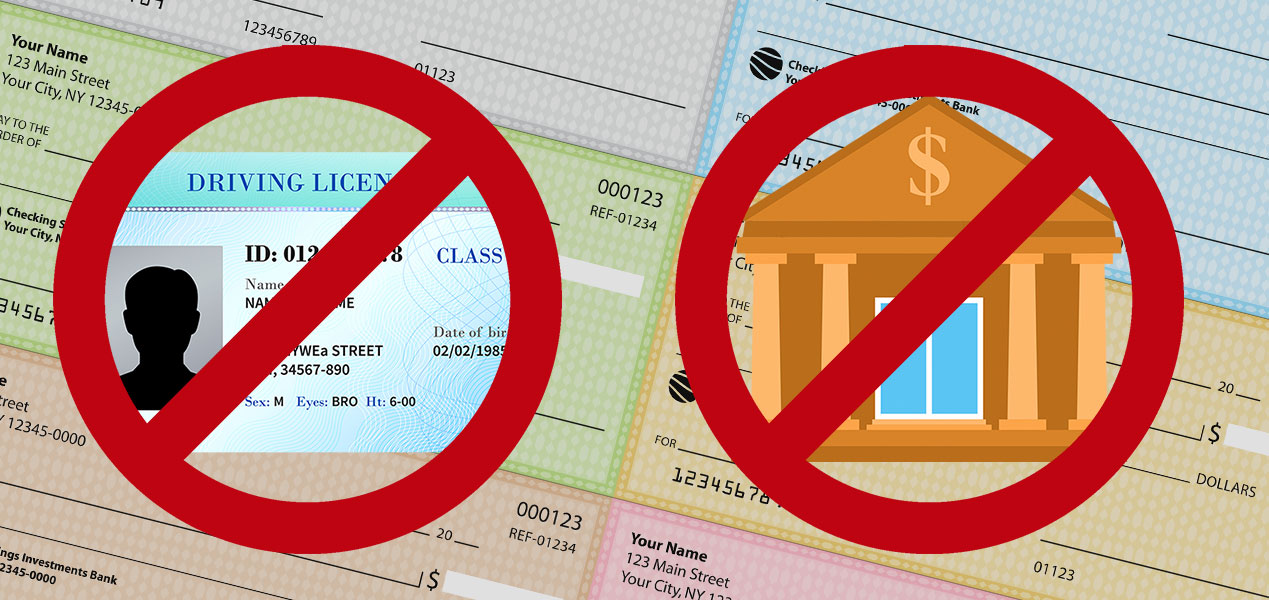

Other can cost you: Getting an alternate thread

If there’s a bond along the assets, the new a fantastic equilibrium of one’s thread would have to be cancelled. According to the monetary preparations amongst the functions, the receiver of the home elizabeth in respect of the property till the transfer could well be allowed.

Attorney’s costs is payable according of thread termination, thread membership plus the transfer of the property predicated on recommended prices. It is recommended that quotations of the many will set you back be bought so you can make sure that there are no unanticipated expenditures.

Simply how much is it possible you be able to spend on the fresh new bond?

Further towards the over, in the event the a family member would like to provide their immovable assets and it is still fused, the newest receiver will have to establish if they are able the new financial. The latest contribution is actually of the property value, no matter if discover a thread. Southern Africa’s largest mortgage investigations provider, ooba home loans, brings a no cost, on the internet prequalification tool, this new ooba Thread Indication, that will help know very well what you really can afford.

Whether you determine to give your property while the something special, otherwise keep it as part of your house, it versions a robust investment that pros everyone. While finding to purchase instance a secured item, ooba home loans also provides a selection of devices that produce the fresh process convenient. Start with their home loan calculators; following make use of the Eva AL bad credit loan ooba Thread Indication to locate prequalified to check out what you can afford. In the long run, before you go, you might make an application for a mortgage.