Certificate regarding Practical Value (CRV) A file granted by Institution off Pros Facts (VA) that establishes the most worth and you may amount borrowed for a beneficial Va financial.

Closing An event stored in order to submit the brand new sale away from property. The buyer cues the mortgage data and you may pays settlement costs. Often referred to as “settlement.”

Closing costs Speaking of costs – past the cost of the house or property- that will be obtain because of the consumers and suppliers whenever move control out-of a property. Settlement costs generally is an enthusiastic origination payment, property taxes, charges for name insurance and you can escrow will cost you, assessment charge, an such like. Settlement costs differ according to area nation and the loan providers made use of.

User Reporting Agencies (or Bureau) An organization you to protects the new preparation out of reports employed by lenders to choose a potential borrower’s credit rating.

Conversion process Condition A provision into the a supply allowing the borrowed funds to be transformed into a fixed-speed will eventually in the label. Constantly transformation try welcome at the end of the initial improvement period. The transformation feature may cost even more.

Borrowing Reason LetterA created letter regarding reason, statements, and you can confirmation so you’re able to file otherwise establish different special borrowing situations. For example discussing derogatory borrowing or any other pecuniary hardship, in addition to bankruptcy proceeding.

Credit file A research explaining a person’s credit score that is made by a cards agency and used by a lender to dictate a loan applicant’s creditworthiness.

Borrowing Chance Rating A credit score strategies a consumer’s borrowing exposure according to all of those other You.S. population, in line with the individual’s credit usage background. The financing rating preferred of the loan providers is the FICO score, created by Fair, Issac and you may Organization. So it step three-thumb amount, between 300 so you’re able to 850, are calculated from the an analytical formula one to assesses various kinds of guidance which might be on your credit file. Large FICO scores means straight down credit dangers, and therefore usually equate to most readily useful loan terms and conditions. As a whole, credit ratings are critical on the mortgage loan underwriting processes.

D

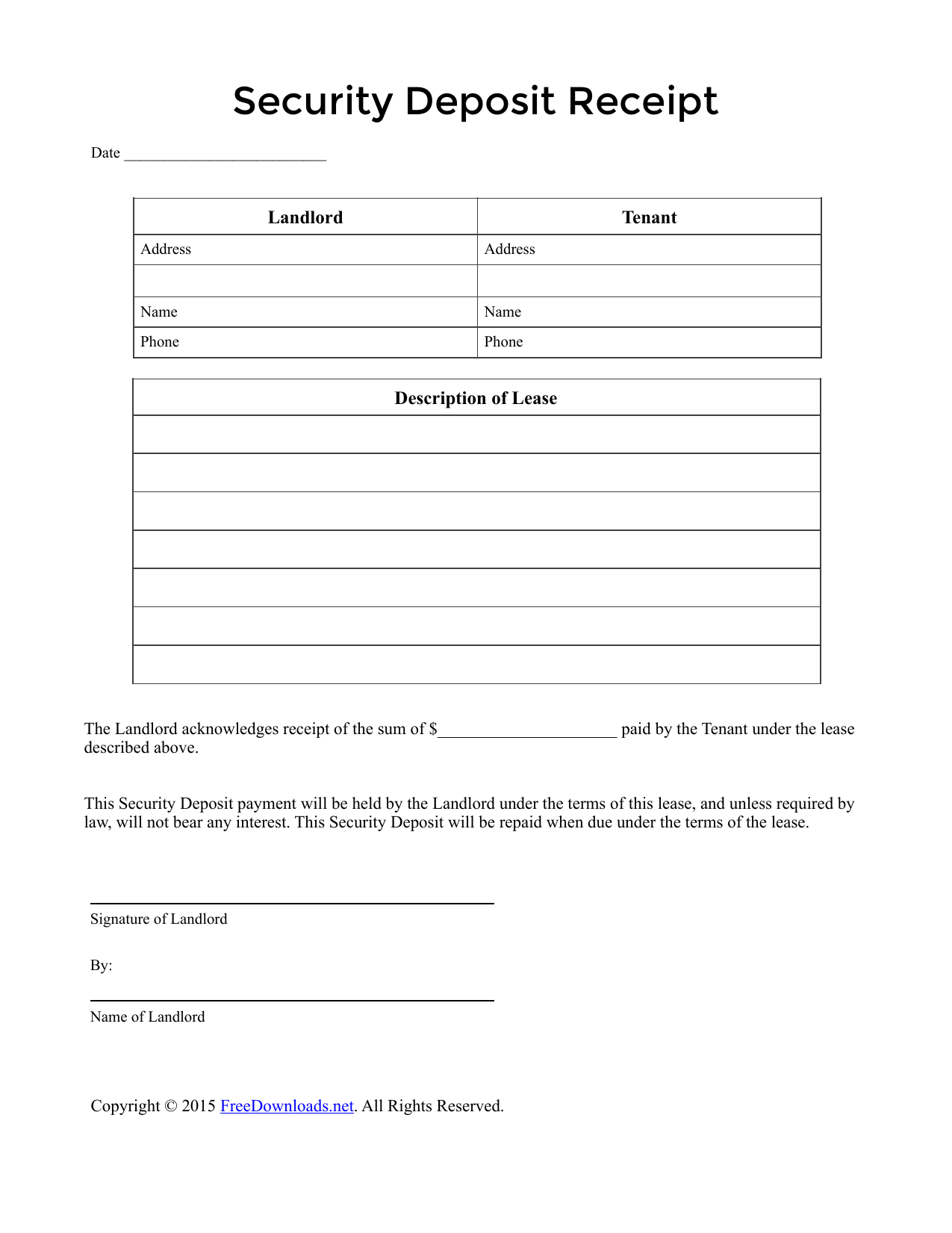

Put This will be a sum of money supplied to bind the deals out-of a residential property, otherwise an amount of cash given to ensure commission or a keen improve out of loans about running of financing.

Write off Into the a supply with an initial rate write off, the financial institution offers up lots of fee issues for the desire to minimize the interest rate minimizing the costs to own element of the borrowed funds title (constantly for 1 12 months or shorter). Following cash advance payday loans Eufaula AL the dismiss period, the newest Arm rate always develops according to its list rate.

Downpayment Part of the purchase price out of property you to definitely are paid in cash and not financed which have home financing.

E

Effective Gross income A borrowers typical yearly money, also overtime that is typical or secured. Salary is usually the prominent supply, however, almost every other earnings will get qualify in case it is extreme and you may stable.

Equity The degree of economic interest in a house. Collateral is the difference between the fresh reasonable ount nonetheless due on the borrowed funds.

Escrow Some really worth, money, otherwise records placed that have a 3rd party to get produced abreast of the fulfillment off a disorder. For example, brand new put regarding loans or files for the a keen escrow membership in order to become disbursed up on the fresh new closing away from sales from a house.

Escrow Disbursements Employing escrow financing to invest a property taxation, danger insurance, mortgage insurance rates, or any other property costs as they getting owed.

Escrow Percentage New part of a beneficial mortgagor’s monthly payment that’s stored from the servicer to cover taxes, hazard insurance policies, home loan insurance coverage, book costs, or any other things as they be due.