A name statement compiles each one of a name organizations search just like the an element of the name insurance rates process. The newest statement includes around three parts: Schedule An excellent, Agenda B-1 and you may Plan B-2.

> Plan A. It part lays away all the facts towards buy or refinance. They’re the new title certification date, information on the brand new insured, the type and you can quantity of insurance policies being issued and exactly how newest customers hold ownership, also known as label vesting. > Schedule B-step one. Which point summarizes the latest files you to functions must provide till the name business normally matter identity insurance. This type of files include:

- Releases of taxation liens

- Deeds of trust regarding previous people

- Home documents

- Stamina from attorney data

- Passing certificates away from residents just who passed away

- Judgments and you can adjustments

> Schedule B-dos. It point lists the items your term organization won’t guarantee. The common exceptions include easements, mineral reservations and you may covenants, criteria and you will restrictions (CC&Rs), that are laws and regulations the first landowner composed.

$255 payday loans online same day Delaware

A title company may help you navigate one requisite alter while in the the brand new closing process, for example adjusting the past loan amount or including a cosigner. A concept officer have a tendency to reissue data so you can reflect any alter. On top of that, if you opt to put your assets significantly less than a trust, LLC or union, a concept manager need to opinion court documents to be sure it fall into line which have identity insurance rates guidance. Finally, a concept administrator usually be certain that your own title at the closing of the looking at documentation, eg a driver’s license or passport.

What’s name insurance policies?

As opposed to typical insurance coverage, and this include you against future occurrences, term insurance coverage handles you against this new property’s background. Specifically, term insurance coverage covers you, given that a landlord, regarding economic losings or judge can cost you off says or litigation relevant to help you early in the day owners.

Brand of label insurance policies

There are 2 types of term insurance coverage – customer’s label insurance coverage and you may lender’s name insurance policies. Lower than are a report about the distinctions between them.

You’re not necessary to purchase owner’s title insurance coverage – still, it will make you long-term peace of mind, whilst persists if you individual your house. Envision identity businesses that give a benefit to own bundling lender’s and customer’s procedures.

Who will pay for lender’s label insurance rates?

Since a homebuyer, you’ll need to pay having lender’s term insurance coverage, although it merely handles a mortgage lender’s demand for a beneficial house and not brand new homebuyer’s guarantee. If you find yourself taking out a mortgage, your lender will demand you to pull out lender’s name insurance policies into the amount borrowed.

Label insurance policies versus. homeowners insurance

If you find yourself title insurance policies have a tendency to protect you from brand new home’s past points inside the ownership legal rights, homeowners insurance will include your residence out-of upcoming factors, such destroy regarding theft otherwise flame. Loan providers will likely require proof homeowners insurance, once you take away a home loan, expect to pay both for lender’s label insurance coverage and you can homeowners insurance.

How much are identity insurance?

An average cost of name insurance selections of 0.5% to a single% of one’s home’s profit rates, but that pricing may differ by state, coverage sorts of while the publicity you require.

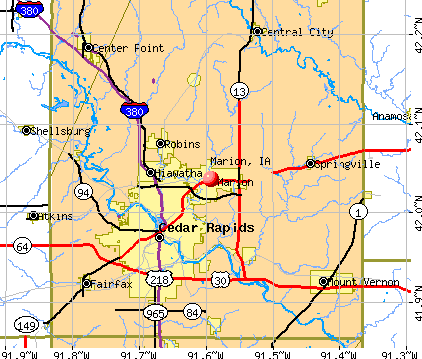

Particular says handle title insurance costs. Iowa’s regulators, such as, underwrites label insurance, which leads to premiums only $175 getting visibility well worth as much as $750,000.

How do i like a title organization?

If you reside in a state instead of repaired title insurance policies, you should comparison shop for the best offer. Ask for guidelines out of your family unit members, family relations otherwise agent. With your homeownership rights at stake, trying to find a concept providers having great support service and you can ratings was essential. Lastly, believe settling the label insurance premiums on merchant on closing, regardless if this can be tricky for the an aggressive housing marketplace.