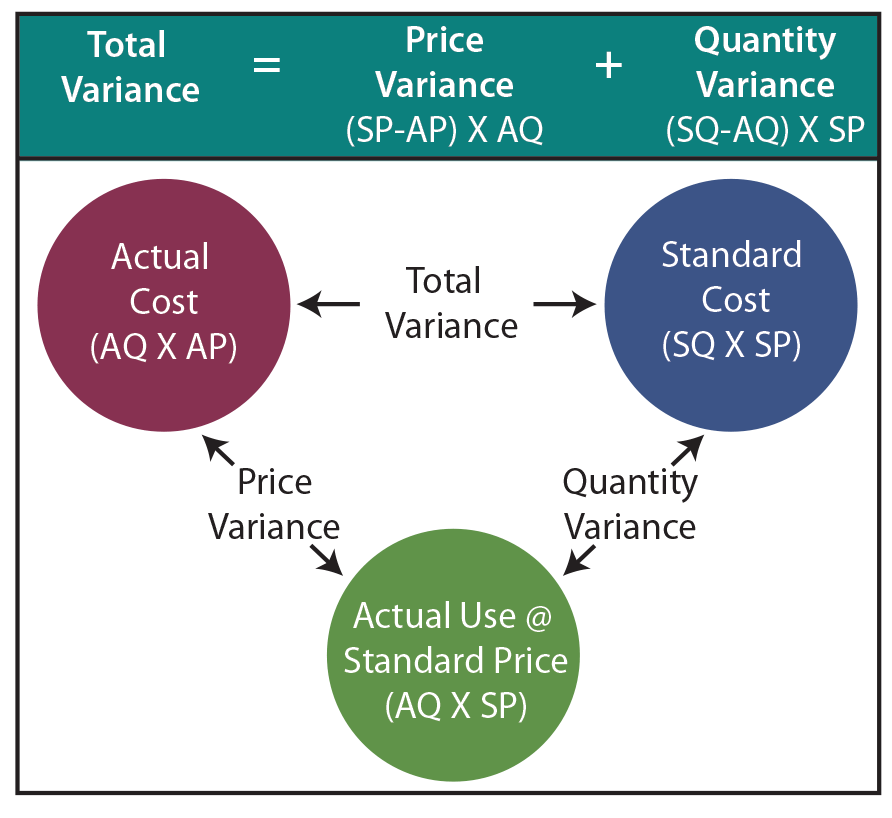

Usually, direct labor rate variance does not occur due to change in labor rates because they are normally pretty easy to predict. A common reason of unfavorable labor rate variance is an inappropriate/inefficient use of direct labor workers by production supervisors. As with direct materials variances, all positive variances areunfavorable, and all negative variances are favorable. Effective management of labor variance is crucial for maintaining a company’s financial health and operational efficiency. Labor variance, the difference between expected and actual labor costs, can significantly impact profitability and resource allocation. Doctors, for example, have a time allotment for a physical exam and base their fee on the expected time.

Why is it important to calculate direct labor yield variance?

This awarenesshelps managers make decisions that protect the financial health oftheir companies. Labor variances also have implications for budgeting and forecasting. Persistent unfavorable variances may necessitate revisions to future budgets, impacting financial planning and resource allocation. Companies may need to adjust their labor cost assumptions, which can affect everything from pricing strategies to capital investment decisions.

Direct Labor Variances

Training employees in these methodologies not only boosts productivity but also fosters a culture of continuous improvement, which is essential for long-term variance reduction. Learn how to manage labor variance effectively with insights on components, calculations, influencing factors, and strategies to optimize financial performance. Hence, variance arises due to the difference between actual time worked and the total hours that should have been worked.

Would you prefer to work with a financial professional remotely or in-person?

It also provides insights into the effectiveness of human resource management initiatives. Another element this company and others must consider is a direct labor time variance. Advanced techniques for us tax deadlines for expats businesses 2021 updated analysis go beyond basic calculations to provide deeper insights into labor performance. One such technique is variance decomposition, which breaks down overall labor variance into more granular components. This allows companies to pinpoint specific areas of inefficiency, such as particular departments or shifts that consistently underperform.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Our Spending Variance is the sum of those two numbers, so $6,560 unfavorable ($27,060 − $20,500). There are several ways Direct Labor Mix Variance can be decreased, but these require training and maintenance of equipment and processes to ensure that they keep working efficiently and the workers need to be motivated. Direct Labor Mix Variance shows how much production is wasted and can be used as a tool to decrease Direct Labor Mix Variance. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License .

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- How would this unforeseen pay cutaffect United’s direct labor rate variance?

- Insurance companies pay doctors according to a set schedule, so they set the labor standard.

- This is an unfavorable outcome because the actual rate per hour was more than the standard rate per hour.

The direct labor variance measures how efficiently the company uses labor as well as how effective it is at pricing labor. Some production environments report labor over short-term periods by way of a balance sheet that includes total direct labor hours and an estimate of cost, using a standard hourly rate. Rather than formally calculating labor variance, it’s inferred by changes to these amounts compared to a budget and past performance. In this case, the actual hours worked are \(0.05\) per box, the standard hours are \(0.10\) per box, and the standard rate per hour is \(\$8.00\).

As a result of this favorable outcome information, the company may consider continuing operations as they exist, or could change future budget projections to reflect higher profit margins, among other things. With either of these formulas, the actual rate per hour refers to the actual rate of pay for workers to create one unit of product. The standard rate per hour is the expected rate of pay for workers to create one unit of product.

An unfavorable outcome means you used more hours than anticipated to make the actual number of production units. All tasks do not require equally skilled workers; some tasks are more complicated and require more experienced workers than others. This general fact should be kept in mind while assigning tasks to available work force.

Other potential causes include changes in technology, raw material costs, and production processes. The more Direct Labor Mix Variance is decreased, the less wasted resources are on production, and the better chance there is that products will be produced within their optimal amount of time. Note that in contrast to direct labor, indirect labor consists of work that is not directly related to transforming the materials into finished goods. Examples include salaries of supervisors, janitors, and security guards. Calculating DLYV is important to assess the productivity of labor and identify areas where operational efficiency can be improved.