It is important to note that this unit contribution margin can be calculated either in dollars or as a percentage. To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers. On the other hand, variable costs are costs that depend on the amount of goods and services a business produces.

What is Contribution Margin vs Gross Margin vs Profit?

Variable costs tend to represent expenses such as materials, shipping, and marketing, Companies can reduce these costs by identifying alternatives, such as using cheaper materials or alternative shipping providers. Find out what a contribution margin is, why it is important, and how to calculate it. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations.

Business Cards

Variable expenses can be compared year over year to establish a trend and show how profits are affected. You’ll often turn to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales.

What is a Contribution Margin and How Do You Calculate It?

When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. Fixed costs are claim for reimbursement for expenditures on official business costs that are incurred independent of how much is sold or produced. Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost.

- You can use contribution margin to help you make intelligent business decisions, especially concerning the kinds of products you make and how you price those products.

- A surgical suite can schedule itself efficiently but fail to have a positive contribution margin if many surgeons are slow, use too many instruments or expensive implants, etc.

- The following frequently asked questions (FAQs) and answers relate to contribution margin.

- Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10).

- This is the only real way to determine whether your company is profitable in the short and long term and if you need to make widespread changes to your profit models.

The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing $0.72 to profits. For the month of April, sales from the Blue Jay Model contributed $36,000 toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line.

Contribution Margin for Overall Business in Dollars

The contribution margin is the amount of revenue in excess of variable costs. One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. Assuming factors like demand and competition are equal, the company should make the product with the highest return relative to variable costs in order to maximize profits. Contribution margins are often compared to gross profit margins, but they differ.

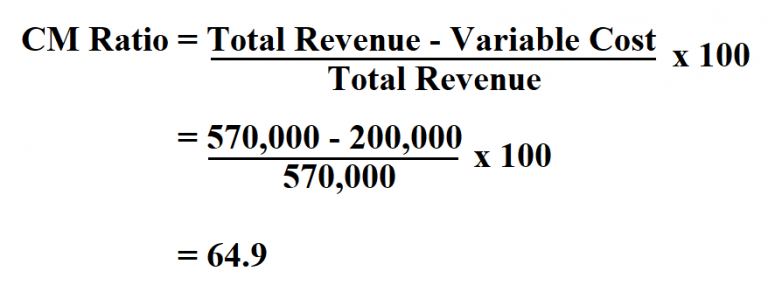

Knowing your company’s variable vs fixed costs helps you make informed product and pricing decisions with contribution margin and perform break-even analysis. Contribution margin (CM) is a financial measure of sales revenue minus variable costs (changing with volume of activity). After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs. By multiplying the total actual or forecast sales volume in units for the baseball product, you can calculate sales revenue, variable costs, and contribution margin in dollars for the product in dollars.

For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit. The contribution margin is important because it gives you a clear, quick picture of how much “bang for your buck” you’re getting on each sale. It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all. It’s also a helpful metric to track how sales affect profits over time. Variable expenses directly depend upon the quantity of products produced by your company.