Gift money are a good investment but many homebuyers manage not have a member of family that is able to provide them with currency to possess a deposit no expectations of fees.

If you find yourself one of the most significant you to gift fund commonly a choice, here are 5 creative ways to put together their off percentage which might be accepted by the really lenders:

Bank guidance generally speaking require that you reveal that the money your are utilizing for your advance payment be in the accounts for at least two months before you could use it to own down fee. That is named seasoning out of fund.

If you discover a reimbursement immediately following processing your income taxation, it cash is already noticed seasoned hence doesn’t need extra seasoning just before getting entitled to explore to possess down-payment.

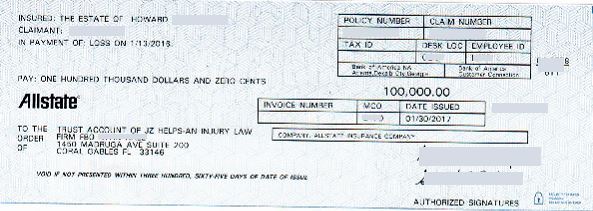

dos. Explore Insurance policies Payment / Court Honor since the Down payment

Monies gotten thanks to an insurance coverage payment or legal honor may noticed sourced and you may seasoned regarding conference deposit guidance.

It is important your specifically approved the latest payout regarding the insurance coverage personal loan companies Kingston PA or courtroom award. Should your payout or award was granted to a corporate, organization or any other entity make an effort to give a magazine walk one names your while the a receiver of one’s financing otherwise records the portion of the award/payment.

For-instance, for many who receives a commission since the reward into the a legal proceeding, you will want the actual court documents stating that your situation might have been fixed, naming your as person of the honor.

For those who located money as a result of an insurance allege, a duplicate of your own claim and you will prize may be required. Generate a duplicate of every inspections obtain ahead of placing money into the bank account.

If you have higher activities lying around, eg an auto, which you can use brand new proceeds of one’s business instantly given that advance payment into the a property buy.

Documentation: It is critical to file the fresh new selling because the throughly as you are able to. Ideally, build duplicates away from papers exhibiting that you are currently the last holder and you got a directly to sell said products an example might possibly be term with the auto you’re selling.

An earnings order, conversion offer or bill will in addition be needed ensure that the quantities of the brand new product sales is similar to the look at or payment received for the property ended up selling.

Of numerous 401ks otherwise senior years arrangements get allow for a-one big date loan with beneficial installment terms and conditions into the reason for to find an excellent holder occupied domestic.

Currency borrowed from your own 401K or old-age plan represents both sourced and you may seasoned and that is appropriate to many lenders just like the an effective legitimate supply of deposit.

Documentation: A copy of the borrowing from the bank guidance from the 401k otherwise senior years package explaining the capability to use for home buying might be expected. Small print of your loan need to be authorized by the lender.

Some companies enjoys customer advice software open to help team get manager occupied land. If for example the manager offers property control system, you might be able to utilize this type of financing as the sourced and you can knowledgeable finance.

Documentation: Just be sure to totally document the brand new small print off the brand new workplace loan and have they approved by their financial first. If you work with one and he scribbles aside a page you to definitely states he’ll give your currency, that would be a challenge once more, focus on it by your bank very first to be certain the program is acceptable.

Once you have affirmed that the direction program is acceptable towards the lender, build duplicates of all of the inspections and you will financing terms and conditions because costs have a tendency to factored into your obligations so you’re able to money rates and might connect with qualifying.

In the event the money from the 401k are delivered straight to your within the the form of a check, make a duplicate of the have a look at before depositing it into the family savings

Qualifying Notice: Credit currency for usage since the a downpayment may not be anticipate but away from unique offer as discussed above. That cash is obtained once the that loan, the money could well be found in your debt so you can income rates and may even apply at the being qualified.

If the records otherwise regards to some of these above possibilities be a challenge into bank, placing the money to your savings account and you can keeping it within the around to possess two months will meet the brand new seasoning standards of all of the lenders.

It is necessary which you talk to your lender when you are probably have fun with these alternative methods getting obtaining the downpayment on the family buy.

The biggest complications you to any of these options gifts was documenting this new papers trail that displays you are permitted new spend otherwise fund while the terms and conditions encompassing the new receipt of such loans.

Tough circumstances condition is you need to 12 months the money (it should sit in your bank account) to own two months.

If you have any queries on the some of these tips otherwise almost every other client guidance strategies, feel free to make inquiries less than or shoot me personally a message and I am going to respond soon.