Underwriting a student-based loan is a little distinct from other forms off personal debt. With individual finance, you nevertheless still need to undergo an endorsement procedure, however with federal loans you can find less strict criteria.

Of several or all businesses searched give payment so you’re able to LendEDU. Such profits is how exactly we manage the free solution for consumerspensation, including times of when you look at the-breadth article look, decides in which & exactly how enterprises appear on our very own site.

For the cost of university fees increasing yearly on the Joined Claims, more children end having fun with student loans to help you let afford the will set you back.

Searching to own grants and you may cut back up to you are able to, but you can still has actually a financing gap. This is when obtaining figuratively speaking have been in.

Having private student education loans, though, there is an underwriting processes. This can be similar to home loan underwriting otherwise underwriting to have an automobile or unsecured loan, but discover differences also.

What’s Mortgage Underwriting?

When lenders you will need to decide if you are a good chance prior to making a last decision, it take you because of an enthusiastic underwriting techniques. This course of action was designed to determine the right that you will have the ability to pay your loan.

Your credit history is actually pulled, along with your credit rating, financial statements, earnings, and you can tax statements. So it papers might be considered to figure out if you’ll end up able to handle monthly installments afterwards. To your private education loan underwriting techniques, your own college or university possibilities and you will major might also be believed, in the place of home financing software.

Discover, though, by using government student loans, i don’t have the same underwriting processes. Subsidized and you can Unsubsidized Lead Funds are around for undergraduate and you will scholar children, despite credit disease. Government Plus finance to own mothers and you will graduate pupils, even if, would want a limited credit score assessment.

Whenever bringing personal college loans, you will be susceptible to the underwriting procedure, much like you’d be for folks who desired to acquire using other sorts of obligations. Here is the action-by-action means of the mortgage software and you will underwriting techniques to possess a good private education loan.

Important information add

As you sign up for a private student loan, you really need to assemble specific documentation while having determining information offered with the underwriting procedure. Before you done an application having an educatonal loan, make sure you have the following the pointers offered:

- Identity

- Birthdate

- Social Coverage matter

- License or other county-granted ID number

- Most recent advance cash phone number home address

- Contact number

- Email address

- Earnings

- Obligations payments

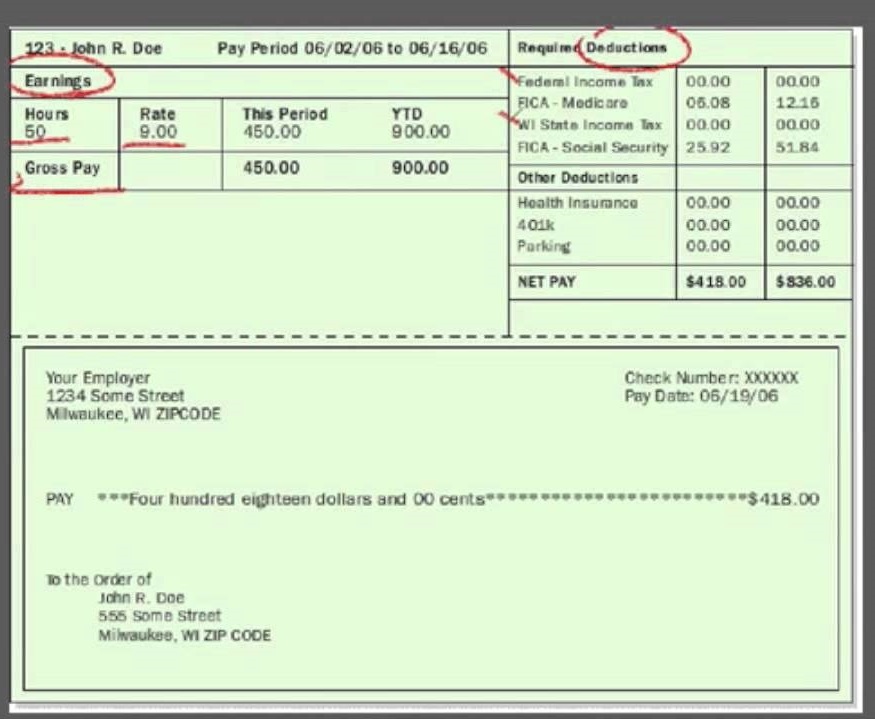

You can also be required to upload most documentation, like copies regarding data you to definitely establish their says. Including, tax returns and you may shell out stubs, and additionally lender comments, can help mortgage underwriters be sure your earnings. Their lender statements might also let underwriters see how much your are obligated to pay and you will everything spend every month on your financial obligation or destination any potential warning flags, which refers to your debt-to-money ratio.

When applying for individual student education loans, you also need to share and this colleges you may be deciding on, how much you intend to borrow, and if you would expect to graduate. Certain apps require the prepared biggest too.

Ultimately, most loan providers as well as will let you include a beneficial cosigner on application for the loan. This individual offers the duty to own fees with his otherwise the woman credit would be considered on the underwriting process.

New Recognition Decision

Personal finance companies and loan providers make the recommendations you provide on your loan file and determine once they need certainly to provide you with financing. They eliminate your credit history and look at your credit score to find out if you’ve got an excellent track record that have and also make repayments on the personal debt. Might and look at the cosigner’s credit file, if you have one to.