Providing financial try an important decision. You must do adequate research so you’re able to zero for the into most readily useful possible bargain, if not it does cost you beloved because home financing try a long haul loan usually powering to have 15-20 years. Among the you should make sure is the rate and never having the reasonable you can you can be costly. Attempt it: Only a good 0.5% difference in interest rate (seven.5% in the place of 7%) to possess a good Rs 50 lakh loan can cause high EMI outgo away from Rs step 3.64 lakh to possess home financing having a tenure of 20 decades.

It is https://paydayloancolorado.net/silver-cliff/ thus vital that you be sure to tick most of the correct boxes at first in itself. Listed here are 5 wise indicates another type of financial borrower can be straight down its EMI number.

Evaluate interest levels, find a minimal

Many lenders such as SBI, Kotak Mahindra Bank and you can LIC Houses Fund offer their utmost rates so you’re able to salaried users and you may fees a higher rate into the low-salaried. Sensible costs are usually open to people which have excellent credit ratings therefore you should take a look at best price you might get against the score and you will total credit file. Which have a lady debtor given that a beneficial co-applicant may also be helpful your decrease your attract from the 0.05%. Therefore, by using the mortgage together together with your lover you might obtain a good price. Put another way, the lowest rates is not open to most of the individuals and regularly is sold with certain small print. Very shortlist at the least 5-7 lenders and then start checking their small print so you’re able to wallet a low speed.

?Pick the proper assets

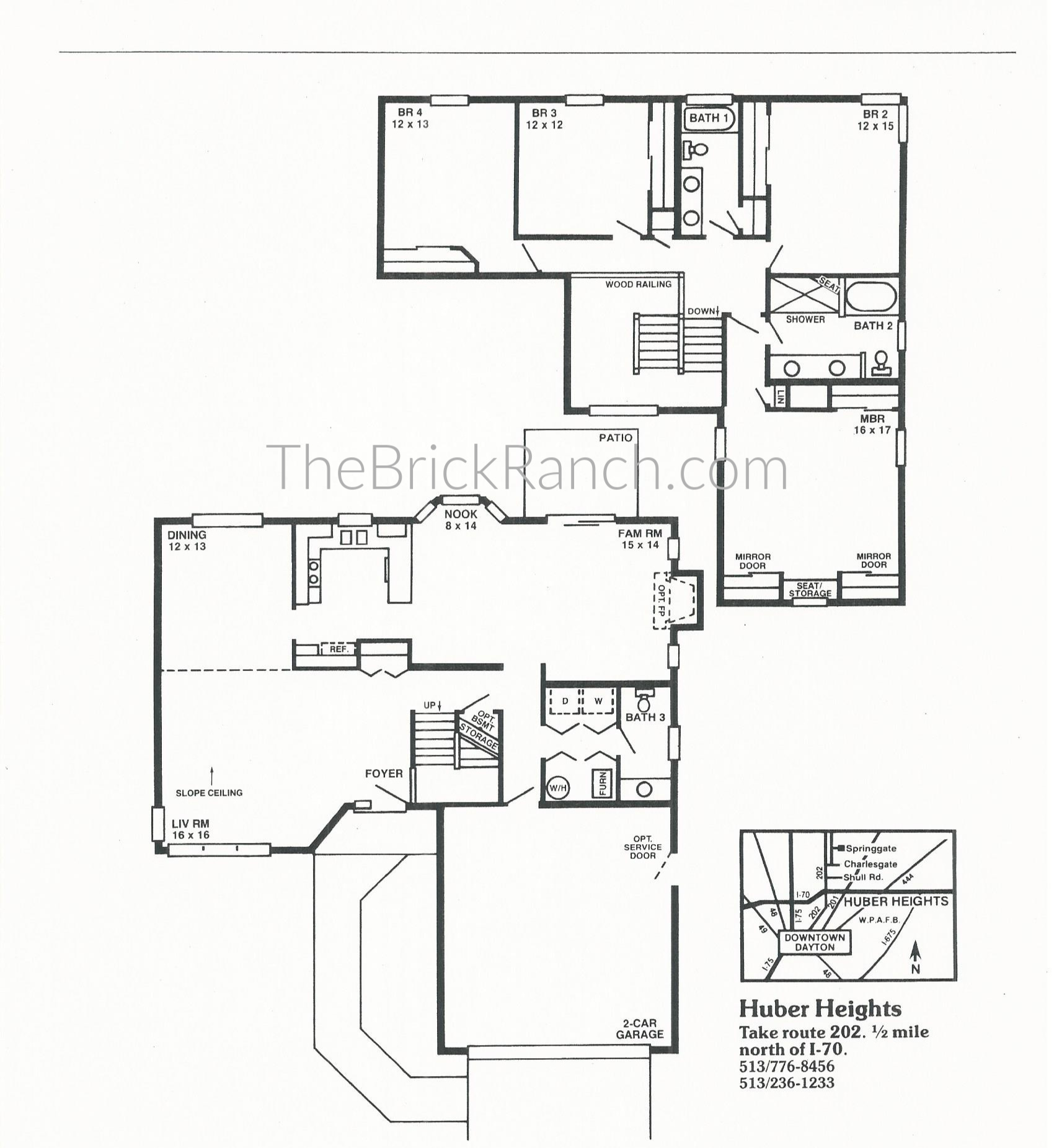

Often, the speed is not the problems, the home is actually, due to that the financial may not accept the borrowed funds owed. Of many loan providers possess negative number having brand of features and you may localities in which they don’t really expand fund. Thus consult with your when it potential property is funded, before you could submit it. When your property is about negative record, you can either need to go for the next ideal financial or fine tune your home choices in a sense one to they matches brand new requirements of lowest rate bank.

?Policy for large down-fee

Most loan providers allow the lowest rate of interest to borrowers exactly who support the financing so you’re able to well worth (LTV) ratio reduced through large down-repayments. Very, if you’re able to build an all the way down-payment regarding significantly more than 20-25%, you should buy the lowest speed offered by the financial institution. Thus a higher down-commission just reduces your EMI by keeping the a great matter low, additionally, it may produce a diminished interest for the loan.

?Opt for a longer tenure

Another option is to borrow cash with an extended tenure. By way of example, if you’re taking an effective Rs forty lakh mortgage on eight.5% per annum interest rate that have a good 20-seasons tenure, the EMI will be Rs 32,224. But not, if you pick a twenty five-12 months tenure this new EMI comes down to Rs 29,560, while away from a thirty-season tenure brand new EMI is Rs twenty-seven,969. Yet not, extended the brand new tenure of financing, higher could be the overall attention commission. So, this should be the last resource option. Additionally, whenever you can afford to blow increased EMI number, you ought to get the mortgage restructured and reduce the newest tenure, otherwise begin making limited prepayments.

?Did you know from the home-saver loans?

If you have fluctuating money and are also looking freedom to have certain days once you will have to pay less EMI count, up coming a house-saver financing can be a choice. Talking about much like the overdraft studio, where your lowest obligation stays to blow the fresh new month-to-month interest simply. Very temporarily, you could potentially decrease your monthly payment to just the interest amount and whenever you are comfy you could restart paying a high amount to slow down the dominant the. Yet not, just remember that , this type of finance will already been within large interest rate, and you can wind up using 0.15 to just one% high focus as compared to a consistent mortgage.