Considering a home security financing however, being unsure of how much cash guarantee you have?

A home collateral mortgage is straightforward, if you’ve got brand new equity in order to back it up. And that is, practical question is not will you be accepted, but instead, exactly how much could you be permitted use?

Before applying for a financial loan you need to be certain that you may have guarantee on your property. We now have created a straightforward on line home guarantee calculator product to give your a concept of what you may meet the requirements so you’re able to obtain.

Family Guarantee Online calculator Exactly what You will need

What you will need to assess your property security actually hard to score. You may need a price of the appraised value of your home and you can a summary of all an look at this now excellent mortgage loans (including HELOC’s). Are we are only looking to decide how much you qualify to help you use, you don’t need to discover the financial prices or mortgage payments at this time. On top of that, you will need to become one liens (i.elizabeth. Money Canada financial obligation) registered facing your property. And you will, If you are unsure when you yourself have a beneficial lien, a concept research is held to find out.

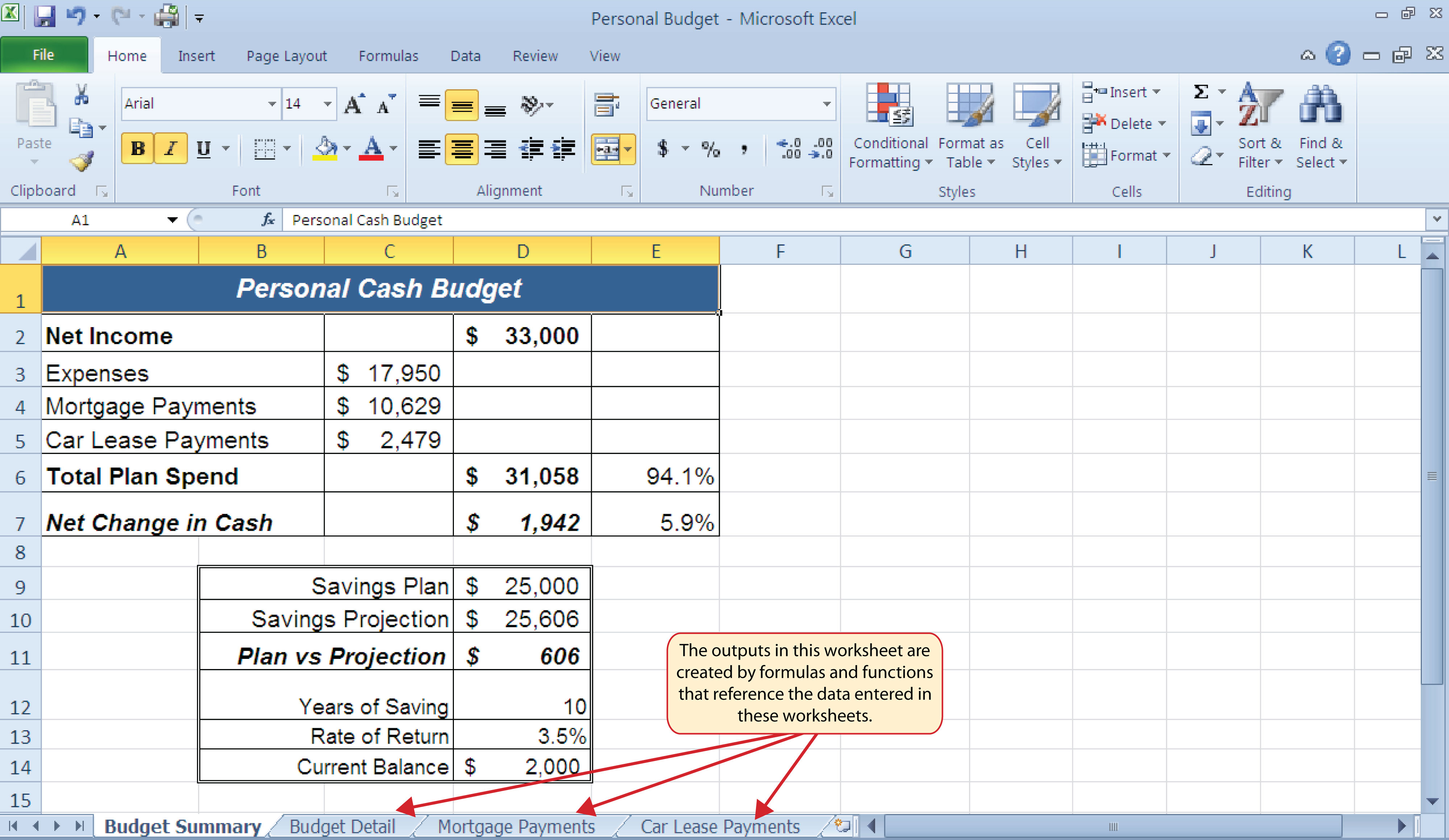

Our very own effortless house equity formula product really does brand new math for your requirements. Just type in your house’s estimated value with for each and every financial/lien and we will determine how much cash equity you have got within the your home.

Second step Being qualified

If you have managed to make it to that particular step, you can now submit your details and click how much are We entitled to acquire to ascertain exactly how much you’ll be able to be eligible for. Approvals should be given in as little as twenty four hours, and we’ll help to understand your position, especially if you’ve been turned down getting borrowing from the bank somewhere else.

Additionally, we are able to determine whether or not you’ll be eligible for an effective safeguarded family guarantee loan or credit line. Additionally, we are able to discuss strategies to make it easier to decrease your monthly payments and you can change your credit history.

Poor credit Timely Approvals

Luckily for us, we are not impeded like other large creditors. Along with, i’ve numerous lending products out of both institutional and personal loan providers that happen to be prepared to overlook credit and you can earnings things.

The on the web domestic security financing approvals depend on the total amount of security of your home not your earnings otherwise credit rating. Similarly, you don’t need to proper care when you yourself have a history bankruptcy proceeding otherwise individual proposition.

To sum up, really the only significant standards lenders examine ‘s the number of security you have got. Being qualified are equity-created which means less than perfect credit can not hold you right back if you have got equity. We could help your replace your poor credit get that have a house guarantee mortgage so you can consolidate highest-desire obligations.

Collateral put rather than guarantee kept

Once you’ve registered the rates into our house collateral calculator you will notice a bar representing your own security made use of in place of this new equity you really have remaining. Without having people collateral a poor count will look additionally the club could be full. Conversely, the greater amount of security you have the finest, but even after limited collateral, you may still features choices.

Albeit, there are a great number of lenders ads that you could borrow to ninety-95% of one’s property value your home. That said, very credible loan providers will not surpass approving financing for much more than just 80-85% of their well worth.

Just how much carry out I qualify for?

has actually simplified the entire process of delivering approvals on fixed-rates house security finance. Most of the time, we could policy for homeowners so you’re able to use to 85% of your own value of their homes. Because these funds is actually acknowledged centered mostly in your collateral, in lieu of borrowing from the bank otherwise earnings, they’re accepted and finalized easily.

What about the house guarantee personal line of credit (HELOC) alternative?

Regrettably, being qualified to own a beneficial HELOC is not as as simple a security financing. A home security line of credit things in the things like credit and you will income. You’ll have to demonstrate greatest borrowing from the bank and you may income become qualified. But, you may still find loan providers that simply don’t require the best debtor.

Even after getting more difficult in order to qualify for, he’s yes worthwhile for people who be considered. While a house equity loan is available in a lump sum payment an excellent HELOC may be used same as a charge card and you pay only on which your use. At the same time, the rate is sometimes a lot more certified and terms and conditions are a bit significantly more flexible. Anyway, utilising the collateral in your home to combine financial obligation is almost always a terrific way to save money.

Exactly what do you are helped by us having?

Now that you understand how far equity you may have, we could feedback their borrowing choices. At the we realize that each state differs. Shortly after approved, you can make use of your house guarantee financing to own a wide variety from motives:

- Debt consolidation reduction combine your own higher-attract financial obligation with the one sensible commission

- Family Renovations build repairs or updates to increase your property worthy of

- Possessions Income tax Arrears catch-up to your possessions taxation arrears to guard your property

- Foreclosures end a foreclosure otherwise fuel out of selling by making up ground towards home loan arrears

- Canada Cash Obligations pay back Revenue Canada debt and stop an income tax lien or garnishment

- Individual Proposition Payout finish/pay off a suggestion to evolve your credit score

If you have equity, we produced being qualified practical, effortless, and simple. And we will inform you while you are accepted in 24 hours or less.