Way too many Us americans struggle with personal debt. A study held by Hometap during the 2019 from nearly 700 U.S. homeowners revealed that although residents are domestic-rich, also dollars-poor, with little to no big date-to-go out exchangeability. Questionnaire takers conveyed when they did provides loans-100 % free the means to access their home’s collateral, such as for example property guarantee improve, they had utilize it to repay personal credit card debt, medical costs, if not assist friends pay-off financial obligation.

Of many home owners answered that they have not even believed possibilities so you can make use of their property collateral. Basically, they feel trapped since the offered financial choice simply frequently create a great deal more personal debt and you can attention towards the homeowner’s month-to-month equilibrium sheet sets. There is also the issue away from degree and you may approval, because it’s hard to meet the requirements of many financing alternatives, including property guarantee loan, with poor credit.

The good news? That it domestic steeped, bucks bad condition quo does not have any to keep. Right here, you’ll learn concerning need for borrowing from the bank, and exactly how you might however accessibility your property collateral if your own try less than perfect.

What is actually Borrowing from the bank and just why Will it Amount in order to Loan providers?

Borrowing from the bank is the capability to in order to borrow money, get activities, or play with functions if you find yourself agreeing to provide commission during the an afterwards big date. The definition of credit rating identifies good about three-hand number that ways the degree of sincerity you’ve exhibited into the for the last by way of experience in loan providers, lenders – basically, any business that has offered you currency. This article is attained when you look at the a credit report because of an option of various source, quick payday loans Simla for instance the amount of credit cards you may have, also any an excellent balance to them, their reputation for money and you may fees choices, timeliness from invoice percentage, and significant troubles such bankruptcies and you will foreclosure.

In other words, lenders wish to be as the yes as you are able to which you’ll pay straight back any cash they supply to you personally, and you can checking your borrowing from the bank is an easy and seemingly total means to get this information.

While carrying enough personal debt as they are worried about your borrowing from the bank, it might seem that your particular domestic security are unreachable. But with a separate, non-obligations financing alternative open to several homeowners, you will be surprised at what you can accessibility. Here are a few methods for you to utilize your residence equity first off playing with one liquidity to-arrive debt wants. ?

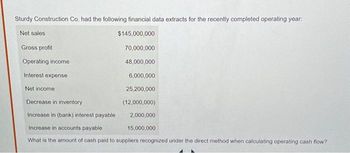

Comprehend the chart lower than to have an easy summary of the options that will be around according to your credit rating, next continue reading for more for the-breadth descriptions of each and every.

Cash-Out Re-finance

A cash-away refinance occurs when you, the homeowner, pull out a new, larger mortgage, pay your current home loan, and employ the extra to cover your position. You can do this during your established bank otherwise yet another financial that’s perhaps not noticed the second financial. Predicated on Bankrate , you usually you would like no less than 20% guarantee on your own property so you can qualify, and you may spend attract into life of the loan (always 15 otherwise 30 years). Of the much time lifetime of a finances-aside refi (as these are generally sometimes known), you ought to make sure the interest rate and your asked installment plan go with their month-to-month budget. Property owners are generally required to possess a credit score the least 620 as approved to have a finances-aside refinance.

Family Equity Mortgage otherwise Domestic Equity Line of credit

Could you be eligible for a home guarantee mortgage otherwise a property collateral line of credit (HELOC) which have less than perfect credit? Very first, you have to know the difference between these two household security selection.

A house collateral loan enables you to borrow funds by using the security of your home as the collateral. A great HELOC, on top of that, functions more like a credit card, in the same way you could mark funds on a for-expected foundation. Which have one another house security fund and you will HELOCs, your credit score and family guarantee worth will have an associate in how far you can easily acquire along with your interest price.

The minimum credit rating you’ll need for property equity financing and you will an effective HELOC are usually at the very least 620, though it relies on the lending company. However, even though you cannot see this minimum credit history to own a home equity mortgage otherwise HELOC, you shouldn’t be discouraged. Julia Ingall that have Investopedia says people with bad credit is to comparison go shopping for loan providers open to coping with consumers instance him or her. On top of that, Ingall notes one to handling a large financial company can help you consider your options and you will support legitimate loan providers.

Household Equity Improve

Property security get better also offers homeowners the capacity to utilize the long term value of their house so you can availableness the equity now. Property security money was a simple way to accomplish merely you to.

Within Hometap, homeowners can also be discovered house security financial investments for them to use a number of the security obtained built-up in their home to complete other monetary goals . Brand new citizen will get cash without having to promote and take aside that loan; and there’s no attention and no payment per month. . Other benefit away from a beneficial Hometap Capital is that numerous points is considered to accept a candidate – credit score isn’t the defining standard.

Offer Your residence

For the majority, it is a history hotel, however, home owners having bad credit have access to their house’s security by attempting to sell it outright. However, it decision was predicated through to looking for a more affordable family getting your following domestic, as well as beneficial home loan terms and conditions for your the brand new put, and you can making certain that you do not invest a lot of with the home fees or moving costs. In addition might possibly change your credit history just before you reach this aspect. Keeping track of your credit score to store a close look aside to own potential disputes and you will discrepancies, maintaining a balance better using your credit limit, and you can remaining old membership open all are an effective towns to begin with.

Whenever you are perception house-steeped and cash-terrible such as for example too many People in the us , you’ve got many choices to availability your home equity. Just like any biggest resource decision, consult with a dependable monetary elite to decide your very best way away from action, and also swinging on your aims.

We carry out our far better make certain the information in this information is because the appropriate that one can at the time of this new day its composed, but anything alter quickly both. Hometap will not endorse otherwise display any linked websites. Individual points disagree, therefore consult your individual finance, taxation or legal professional to see which makes sense to you.