Economic order quantity dictates the optimal inventory levels you need to minimise expenses. These formulas calculate your gross capital inventory at the end of an accounting period. Assuming straight-line depreciation, for allocating the cost of your inventory asset the depletion of fixed capital can be calculated using a formula. Below we cover some of the what is a qualified retirement plan core advantages and disadvantages of perpetual inventory systems. On the other hand, some cons may include additional training for employees to use the system, setup costs, and incorrect inventory levels from mistakes such as entering the wrong quantity. If you or your employees make mistakes while entering inventory, fixing the error can be time-consuming.

- By maintaining up-to-date inventory records, businesses can accurately calculate the cost of goods sold, which directly influences gross profit and net income.

- LIFO (last-in, first-out) is a cost flow assumption that businesses use to value their stock where the last items placed in inventory are the first items sold.

- At all other times, the inventory records under a periodic inventory system will not reflect the amount of inventory that is actually on hand.

- You must choose between a periodic inventory system and a perpetual inventory system.

- Your perpetual inventory system automatically increases the inventory count for that SKU by one, immediately as each unit is scanned.

- As this series of journal entries shows, the balance in the Merchandise Inventory account at a particular time should reflect the actual cost of the goods on hand at that time.

How confident are you in your long term financial plan?

Through ShipBob’s dashboard, ecommerce brands can achieve real-time visibility into inventory levels and track SKUs as they are received, stowed, picked, packed, and shipped to customers. In order to be more precise when ordering inventory items, formulas can be used. There are several formulas business owners can use to keep track of physical inventory counts.

The Ultimate Guide to Perpetual Inventory Systems: Benefits, Implementation, and Best Practices

The perpetual system may be better suited for businesses that have larger, more complex levels of inventory and those with higher sales volumes. For instance, grocery stores or pharmacies tend to use perpetual inventory systems. A business should use a perpetual inventory system when it needs to have a detailed knowledge of exactly how many units are in stock at all times. It is especially important when the inventory investment is large and when there are many product types in stock. Without a perpetual system, a business would not be able to accurately tell its customers exactly when it can fulfill their orders.

Do you own a business?

There are morechances for shrinkage, damaged, or obsolete merchandise becauseinventory is not constantly monitored. Since there is no constantmonitoring, it may be more difficult to make in-the-moment businessdecisions about inventory needs. There are advantages and disadvantages to both the perpetual andperiodic inventory systems. Here, we’ll briefly discussthese additional closing entries and adjustments as they relate tothe perpetual inventory system. They can use a perpetual or periodic inventory system.Let’s look at the characteristics of these two systems. The EOQ formula helps determine the optimal order quantity for a given item, minimizing inventory costs and ensuring sufficient stock to meet customer demand and satisfaction.

Purchase of Merchandise at Cost

On the other hand, perpetual systems provide seamless integration with point-of-sale systems and other technological tools, allowing for a more dynamic approach to inventory management. This capability is beneficial in today’s fast-paced business environment, where agility and responsiveness are paramount. The decision between adopting a perpetual or periodic inventory system depends on factors like business size, transaction volume, and the need for real-time data. Perpetual systems are favored by larger businesses or those with high transaction volumes due to their ability to continuously update inventory records. This system offers advantages such as enhanced accuracy and the capacity to make informed decisions quickly. In contrast, periodic systems, which update inventory at set intervals, are often more suitable for smaller businesses with less frequent transactions.

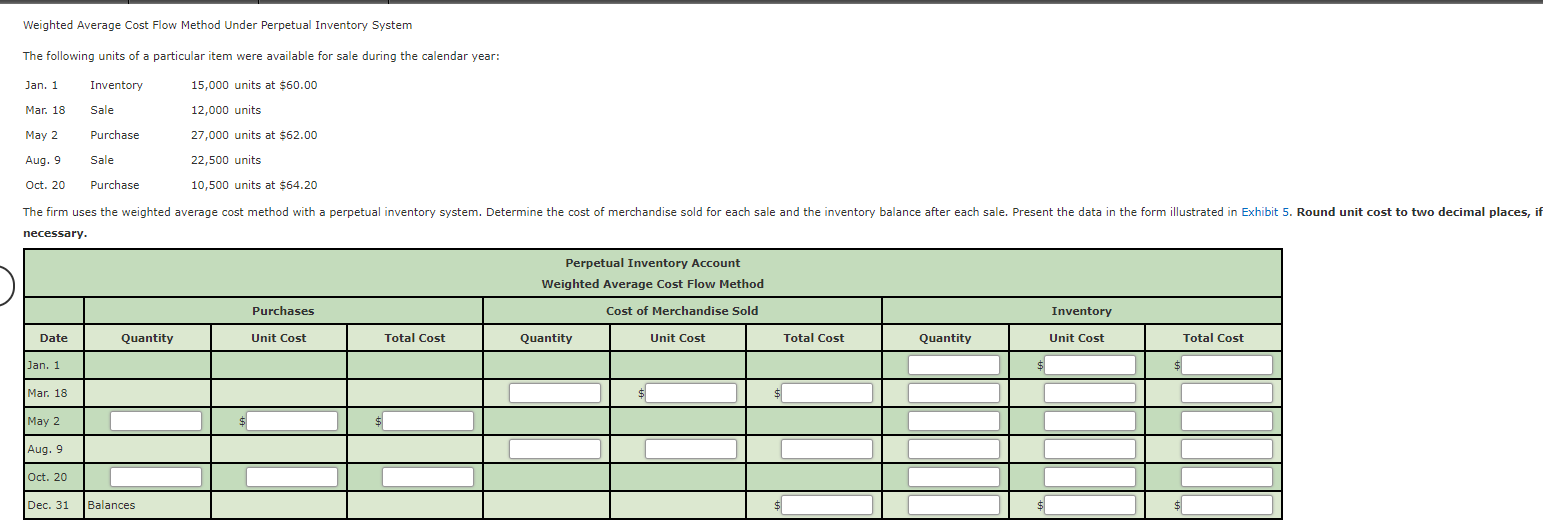

Inventory data is available to all parts of the system to forecast sales trends, calculate reorder points, and source items that are currently out of stock. The Weighted Average Cost (WAC) is the cost flow assumption businesses use to value their inventory. Also called the moving average cost method, accountants perform this differently in a perpetual system as compared to a periodic system.

The average unit cost, COGS for a time period, and ending inventory for a time period can all be calculated using WAC. The cost of goods sold (COGS) is automatically updated and recalculated using the information from the previous phase. You can use the first-in, first-out (FIFO), last-in, first-out (LIFO), or weighted/moving average costing method that you like. Being able to check inventory levels and the cost of goods sold, in real-time, can save your employees and your business a considerable amount of time and money.

As soon as a unit is scanned, the perpetual inventory system automatically increases the inventory count for that SKU by 1. Once all 500 units are scanned, the inventory count should have increased by 500. A perpetual inventory system will learn from the sales data of the past 4 years, and automatically raise your reorder threshold from 25 units to 50 units.

A perpetual inventory system helps streamline the reordering process by alerting you when stock levels are low. This enables ecommerce businesses to set reorder points for each product, ensuring that inventory is replenished before running out. Automation of purchase orders based on predefined thresholds also reduces the risk of stockouts. In a perpetual inventory system, inventory is recorded any time inventory is purchased and received by a merchant or sold to customer.

A company may not have correctinventory stock and could make financial decisions based onincorrect data. The perpetual inventory system is generally more effective than the periodic inventory system. This is because the computer software that companies use makes it a hands-off process that requires little to no effort. Products are barcoded, and point-of-sale (POS) technology tracks these products from shelf to sale.

To meet client demand, you must maintain enough inventory on hand but not so much that your storage expenses are out of control. The process of accounting for perpetual inventories is shown in the following example. Periodic systems involve the completion of accounting at the end of a given period. Instead, prior to the widespread use of computers, the Internet, and other digital technologies, it was common for a company to use a periodic inventory system. When deciding how to maintain control over physical inventory, it’s prudent to carefully weigh both the pros and cons of any system under consideration.