In comparison, you will find reduced-down-payment old-fashioned loan alternatives for earliest-big date homebuyers with down money only 3%. If not, minimal deposit importance of a conventional home loan you certainly will assortment anywhere between 5% in order to 15% with respect to the details of the loan. Of course you want to end paying private financial insurance rates, you will have to render the bank with a down-payment out-of 20% or even more.

Interest rates

FHA financing could possibly get feature attractive financial rates compared to antique money due to the fact government’s support of the mortgage reduces the exposure on financial. But, the rate a loan provider provides you with for the both form of financial can differ according to the sector as well as the details of the financing.

Chance issues like your credit score, debt-to-income (DTI) ratio, downpayment, financing term, and if or not you have a fixed-rate or adjustable-price home loan also can need to be considered.

Financing constraints

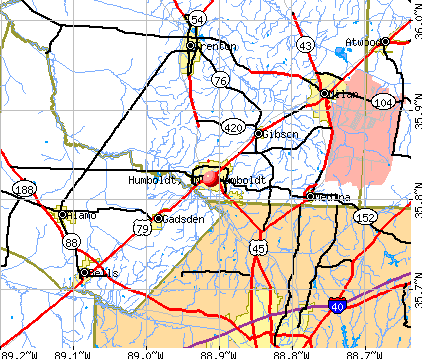

Whenever you are searching for using an FHA financing to order an excellent household, you will need to be aware of the FHA financing limit for your town. Loan restrictions vary because of the state, and you will visit the HUD website to browse the FHA home loan restrict for several cities.

- Low-rates counties: $498,257

- High-pricing counties: $1,149,825

Conforming traditional fund also have financing limitations, but they’re more than FHA loan limits in lots of portion. When you find yourself looking increased-pricing possessions, a normal loan might be a far greater complement your situation in a number of urban centers. To possess 2024, compliant traditional mortgage limits variety is anywhere between $766,550 and you can $step one,149,825 (in the highest-prices section).

The borrowed funds limits on conforming antique loans stem from brand new perform of your Government Homes Finance Agency (FHFA) to steadfastly keep up stability in the housing marketplace.

Fannie mae and you will Freddie Mac computer-with each other entitled bodies-backed organizations or GSEs-lay requirements toward mortgage loans (we.elizabeth., antique funds) that they purchase from https://paydayloanalabama.com/beaverton/ loan providers. The brand new FHFA manages the fresh GSEs and you may kits mortgage constraints with the compliant finance to assist avoid overborrowing and you can foreclosure, which help new GSEs end financial support unaffordable mortgages that may angle extreme risk.

Understand that individuals can also get nonconforming conventional funds, called jumbo loans, when they must acquire more than available loan limits. Although not, jumbo finance normally have stricter qualification standards given that huge mortgage size could raise the exposure with it with the lender.

Mortgage insurance coverage

Mortgage insurance is a policy that provides the lender having safeguards for individuals who standard in your home loan. With an FHA mortgage, the bank will require that shell out 2 kinds of home loan insurance-initial and you may yearly.

The new initial financial premium (UFMIP) having an FHA mortgage is usually step one.75% of one’s legs amount borrowed. You can that it prices into the loan amount for those who don’t have the fund available to shell out initial. Annual mortgage insurance fees (MIP) essentially are priced between 0.45% to a single.05% of one’s amount borrowed. The lender often separated the MIP premium with the twelve payments and add it towards the top of the month-to-month homeloan payment.

Old-fashioned funds also can require individual mortgage insurance coverage (PMI) to safeguard the brand new lender’s resource. But if it’s possible to give a good 20% down-payment on the old-fashioned mortgage, you need to be in a position to stop that it additional cost.

PMI premium may differ considering several points. But not, Freddie Mac computer estimates one PMI might cost ranging from $31 in order to $150 a month per $100,000 you use.

The newest takeaway

FHA money and you may conventional loans depict a couple of more paths to homeownership. An informed financial choice for your position is based on several items, as well as your creditworthiness, your ability to save an advance payment, and how much currency you need to use to purchase your wanted assets.