A number of the criteria that meet the requirements your getting a beneficial USDA financial loan when you look at the Michigan are – income, down payment, credit ratings, and much more. Delivering a good USDA mortgage is not much different than getting a great old-fashioned home loan. Here are 10 things which can perception the loan recognition.

1munity Bank Recognition that have USDA

USDA is actually a government agency one to sponsors the application form, your community financial often deal with 100 americash loans Slocomb % of your exchange. This means your society banker does many techniques from bringing the application to help you providing the very last recognition. USDA leaves a last stamp out-of acceptance into the loan, as well as which is handled from the financial. Suppliers normally lead as much as 6 % of the sales rates to your settlement costs.

2. No Advance payment

The new downpayment requirements – or insufficient one to ‘s the reason a lot of customers choose the USDA mortgage program. Zero deposit is needed, therefore it is one of the few 100 percent money lenders in today’s industry.

You may have an advance payment virtue that would take decades to possess extremely family members to keep 5 per cent off or maybe more. At that time, home values can go up, and also make protecting a down-payment actually more challenging. With USDA mortgage loans, home buyers can purchase quickly and take advantageous asset of increasing family opinions. Minimal credit history to own USDA recognition are 640. The debtor need a relatively a good credit score history that have limited thirty day later repayments within the last 12 months.

cuatro. First-Go out Homeowners

USDA protected mortgages commonly suitable for most of the customer. But, one earliest-go out or recite buyer searching for belongings outside of big cities is always to view its eligibility with the program. The application form is obtainable for sale transaction merely, no investment properties otherwise next homes. A buyer you should never individual a different house within lifetime of purchase.

5. Geographic Limits

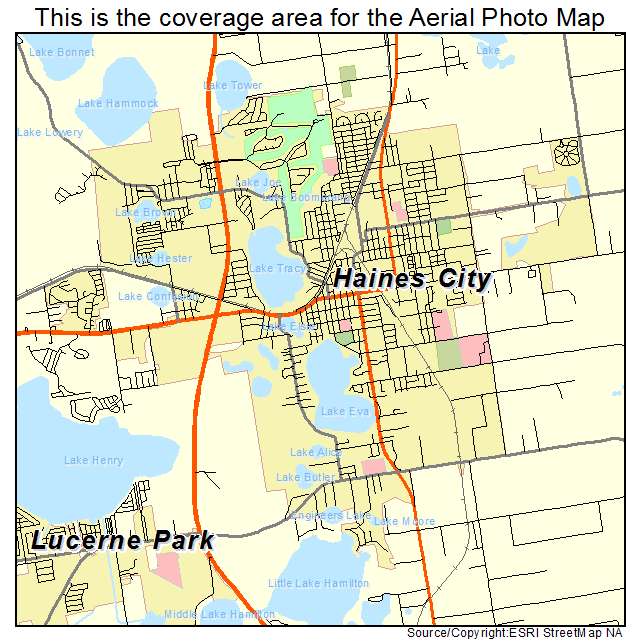

Geographic components having USDA mortgage loans try getting house that must be found inside a beneficial USDA-qualified urban area. To be eligible, a property have to be when you look at the a rural city. Fundamentally, metropolitan areas and places with a people less than 20,000 qualify.

six. Appraisal and you can Possessions Requirments

An appraisal for the property to decide the really worth needs. The fresh new assessment report together with verifies your house is livable, safer, and meets USDA’s minimum assets criteria. One shelter or livability circumstances must be corrected prior to loan closure.

7. House Limits

USDA mortgages are not designed to funds facilities otherwise high acreage properties. Instead, he or she is geared toward the product quality solitary-house. You can also money specific condos and you can townhomes towards system.

8. Number one Household Conditions

Land getting purchased have to be much of your household, meaning you intend to reside truth be told there into foreseeable future. Leasing features, financing features, and you can second household purchases are not qualified to receive the new USDA financial financing program.

nine. Financing Dimensions of the Earnings

There aren’t any stated home loan limits getting USDA mortgages. Alternatively, an enthusiastic applicant’s earnings decides maximum mortgage size. The new USDA earnings restrictions, then, be sure sensible mortgage items towards the system. Money of all the family unit members 18 years of age and you may more mature don’t surpass USDA guidelines here.

ten. Cost Feasibility

You generally speaking you want an excellent 24-day reputation of trustworthy a career in order to qualify, along with sufficient money of said a job. Although not, schooling during the a related career is also change some or every one of one sense needs. Your own financial will determine repayment feasibility.

USDA’s mandate will be to provide homeownership within the non-urban areas. As a result, it creates its loan sensible in order to a bigger spectral range of home consumers by keeping prices and costs reasonable.

Find out more about the many benefits of a beneficial USDA mortgage loan and you can dealing with your regional community financial. Talk to our mortgage loan professionals on Chelsea State Financial. Contact all of our office by the phone: 734-475-4210 otherwise on the web.