Taxation Return Waiver Whether your just source of income was Va handicap and you will/otherwise SSDI, you will never be required to bring taxation statements.

Possessions Tax Waiver Once you purchase the family, you might be eligible for the full elimination of your property fees. It decision is made during the regional peak and can results in a big month-to-month offers. We have no capability to dictate that choice.

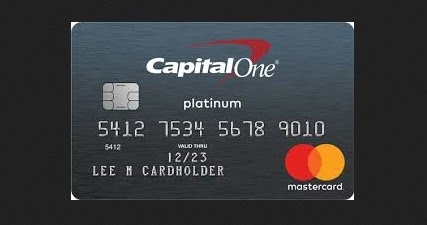

Zero Lowest Credit history There won’t be any minimal credit rating requirement when you yourself have 12 months as opposed to derogatory scratches in your credit history, 2 yrs off punctually houses money, and you may an obligations to income ratio lower than 55%.

Speaking of grand benefits if you find yourself applying for an excellent Va loan. We are able to check their circumstance and can assist you probably know how much you can qualify for.

Dream A mortgage provides a wealth of resources particularly customized so you can the requirements of disabled pros. Contact us now and a loan administrator will help you.

Keeping Good credit for Va Loan Approval

When making an application for home financing, your credit score will get a significant factor. As Va by itself doesn’t always have a minimum credit history demands, private lenders normally would. It means maintaining a good credit rating not just boosts the probability of mortgage acceptance but may in addition to cause more advantageous conditions. We could assist you with score down to five hundred.

Your credit score and you may behavior indebted play a critical character in deciding your credit rating. It’s necessary to just remember that , your credit score is not only good number; it is a representation of your own economic duty. The greater the new score, the greater believe lenders get inside you due to the fact a debtor. To keep good credit otherwise boost it, it’s important to work with multiple secret facets.

When it comes to finding the optimum financial, pros convey more solutions than Va funds. In fact, there are some solutions one to appeal to veterans’ book monetary circumstances and needs. Listed here are just a few examples:

FHA (Government Homes Government) Money

FHA loans is actually a famous choice for some veterans who require to buy a property. They need at least step three.5% down payment, that will be more relaxing for many people to cope with as compared to antique funds. On top of that, FHA funds normally have straight down interest levels, leading them to a nice-looking selection for veterans having already burned the Virtual assistant mortgage entitlement or choose the choice for an FHA Streamline Re-finance .

So it streamlined re-finance choice https://paydayloanalabama.com/scottsboro/ lets pros so you can re-finance its current FHA loan towards the another that that have reduced records and you may underwriting criteria.

USDA (United states Institution out of Agriculture) Loans

USDA loans try a separate substitute for experts. These types of mortgages give a choice that have no-money off, so it is a fascinating option for individuals who might not have a giant down payment saved up. However they commonly have lower rates compared to traditional funds. However, there are particular constraints such as earnings limits, house earning constraints, and you will property area conditions, therefore it is crucial that you cautiously evaluate your eligibility. Read more about USDA loans right here.

Old-fashioned Funds Customized in order to Veterans’ Need

Antique fund can be tailored in order to meet the means from experts. Such as for instance, this new Navy Government Credit Relationship provides the Armed forces Choices Mortgage, designed specifically for provider members and pros. Such loan does not have any down-payment requirements and features a predetermined interest.

Financial Report Funds

For pros who may have non-antique resources of money or desire to get resource qualities, financial report fund would-be a viable alternative. Rather than playing with traditional W2s or income tax paperwork to confirm earnings, this type of fund have confidence in lender comments to evaluate a borrower’s economic balances.