- Pay attention to the qualifications criteria and value before getting a great second possessions.

- The latest latest increase in Additional Client’s Stamp Responsibility (ABSD) setting you would need far more dollars when selecting the next domestic.

- To order the next possessions includes a great deal more financial duty; its advised to get clear regarding the mission for selecting next possessions

Having rising cost of living online loans Atlanta IN controling statements into the current days, interest rates are set to increase after that from the future weeks. For those who have already been browsing acquire the second assets, this might be a good time to begin with looking since a upsurge in rate of interest could possibly mean stabilisation out of assets cost.

Other than the cost of the house, there are several something you’d need to be mindful of whenever purchasing another family, such as qualification, value and you may intent.

Qualification

If you individual a personal assets, then you will be liberated to get a second personal property without the court effects. Although not, in case the basic home is a general public casing, whether it’s a build-to-Buy (BTO) flat, resale HDB flat, exec condo (EC), otherwise Framework, Create and sell Program (DBSS) flats, then you will need certainly to fulfil certain criteria prior to your purchase.

HDB apartments come with a beneficial 5-season Minimum Industry Months (MOP) requisite, which means you would need certainly to consume that assets getting good the least five years before you could sell otherwise rent the flat. You will have to fulfil the brand new MOP before get out-of a personal possessions.

Create remember that simply Singapore owners should be able to own one another an HDB and you may a personal property meanwhile. Singapore Permanent Customers (PRs) will have to move out of its apartment contained in this six months of individual possessions purchase.

Value

Qualities are known to end up being notoriously expensive from inside the Singapore and you can cautious calculations must be made to make sure that your second possessions get stays sensible to you. You’d have to take note of one’s following the:

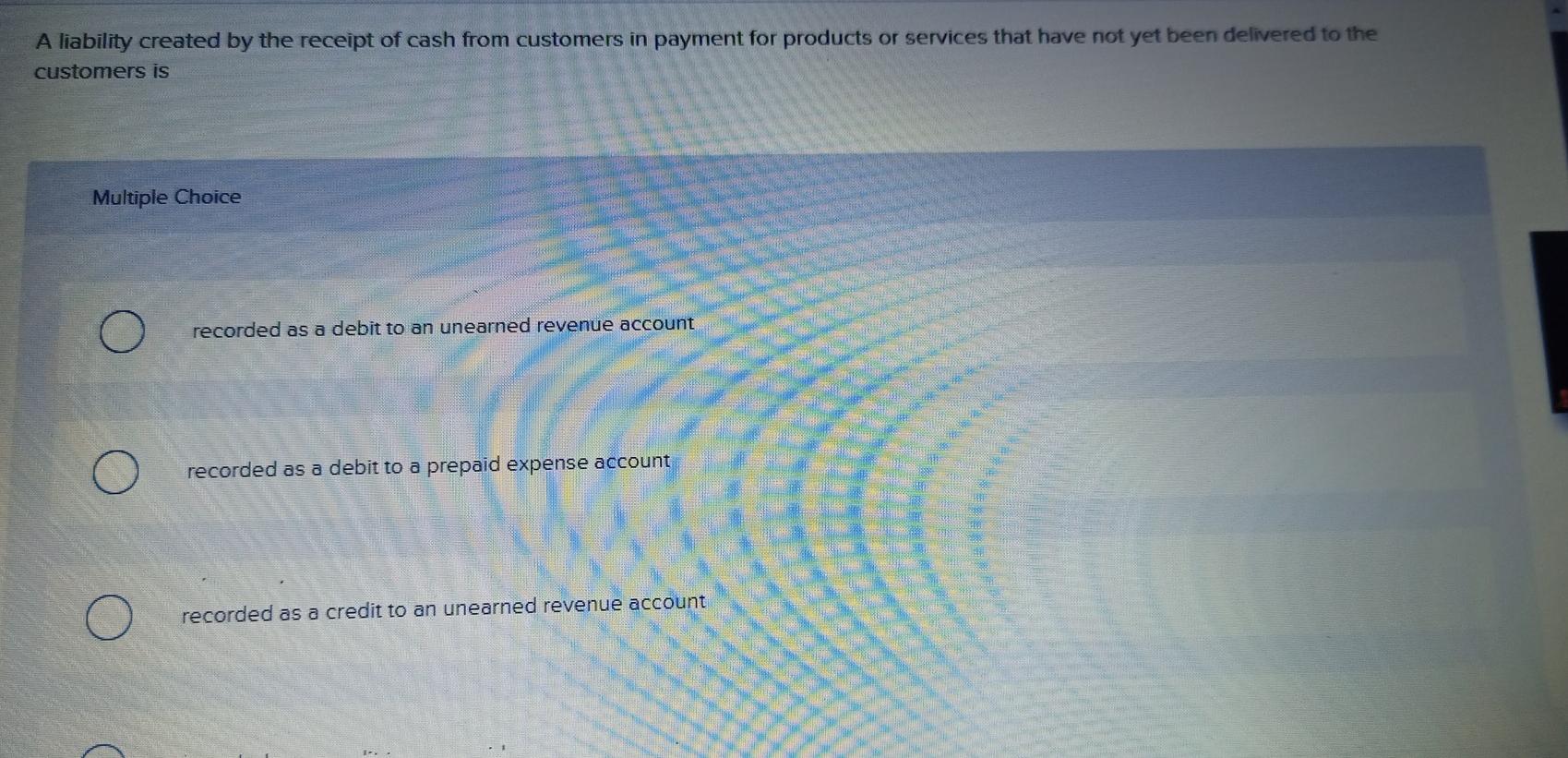

You’ll have to pay ABSD after you buy a second home-based possessions. Extent might have to pay hinges on the reputation.

The brand new ABSD are past modified on the within measures to offer a sustainable assets markets. Latest cost is actually reflected regarding the table less than:

Considering the current ABSD pricing, a Singapore Citizen which already possesses a keen HDB apartment but desires to purchase a private condo costing $one million has to pay an ABSD of $two hundred,000 (20%). Carry out keep in mind that it count is on the top consumer’s stamp obligation.

Very first home get demands simply around 5% bucks deposit if you used a bank loan, however your 2nd possessions need a twenty-five% bucks downpayment of property’s valuation limit. Offered a house that is appreciated on $one million, you would you want $250,000 bucks getting downpayment.

The entire Debt Servicing Proportion (TDSR) structure are produced onto prevent home buyers of credit as well much to invest in the acquisition out-of a home. Beneath the structure, home buyers can only just acquire so you’re able to up 55% (changed into the ) of their disgusting monthly income.

When you yourself have a home loan tied to very first property pick, it can considerably affect the number you could borrow for your second house. However, for those who have already cleaned the loan on the basic house, then you’ll only have to make sure that your month-to-month houses mortgage payments as well as every other monthly bills do not exceed 55% of monthly income.

To suit your first property loan, you are eligible to obtain to 75% of the property really worth when you are taking up a financial loan or 55% in case your loan tenure is over 3 decades or stretches earlier in the day many years 65. For the next homes financing, the loan-to-worth (LTV) ratio drops so you’re able to 45% getting loan tenures up to thirty years. In the event the financing period surpasses twenty five years otherwise your 65th birthday, your LTV falls to 30%.

As you can plainly see, to acquire the second possessions when you’re nevertheless buying the borrowed funds out-of your first family want even more dollars. Considering a home valuation from $1 million, you will probably you want:

While it is it is possible to to make use of the Central Provident Money (CPF) to acquire one minute property, if you have currently made use of the CPF for you very first domestic, you might just use the excess CPF Average Membership offers getting your next property once setting aside the modern Very first Old-age Scheme (BRS) out of $96,000.

Intent

To purchase a second assets comes with alot more monetary obligation compared to the first you to definitely, and is also informed is obvious about your mission to own buying the second property. Could it be to have resource, otherwise are you using it since an extra home?

Making clear your own mission will help you to make particular choices, such as the version of assets, and going for a location who would better suit the mission. This is exactly especially important if your next property is a financial investment possessions.

Like most most other opportunities, you’ll need certainly to workout the potential rental produce and you will financial support prefer, including dictate the newest estimated return on the investment. Just like the property buy is a huge capital, its also wise to enjoys a method you to think situations including:

What is disregard the panorama? Do you endeavor to bring in a return immediately following 5 years, or perhaps to keep they toward a lot of time-title to collect rent?

When and exactly how do you really slashed losses, or no? If your home loan repayments try greater than the lower local rental income, how much time do you really wait in advance of promoting it well?

To get a property from inside the Singapore are capital-rigorous and buying a second family will need even more monetary wisdom. One miscalculation might have high financial consequences. As such, install an obvious bundle and you will demand an abundance considered director in order to that have you can blind places.

Begin Considered Now

Check out DBS MyHome to work through the newest amounts and find a house that suits your finances and choices. The best part it cuts from guesswork.

As an alternative, prepare which have a call at-Idea Acceptance (IPA), and that means you has actually certainty regarding how far you can acquire to own your residence, allowing you to understand your allowance precisely.