Maximum borrowing from the bank limitations for advances are different of the FHLBank, however, aren’t slide between 20% and you may sixty% regarding full property. Member improves pricing repaired otherwise drifting prices all over a beneficial range of maturities, out-of overnight to 30 years. With regards to the current FHLBank Workplace away from Financing buyer https://paydayloansconnecticut.com/darien-downtown/ speech, floating-speed advances happened to be just more 30% out-of overall improves by . The latest maturity out of advances has shortened in conjunction with this specific trend toward a drifting rates: Over 90% out of advances decrease in quicker-than-one to five-12 months diversity towards the end from 2023, a 25% improve over 2021. If you find yourself cost are regularly current and disagree across the financial institutions, Profile step one listing a sample out of cost by .

Since , 580 insurance providers have been people in this new Federal Mortgage Financial (FHLBank or FHLB) program together with borrowed over Us$147 million of it season to date. 1 Insurance company participation on FHLB program actually aids FHLBanks’ constant objective to incorporate affordable lending in order to home-based home loan borrowers. FHLBanks give in order to insurers within very competitive rates, creating prospective chances to create money or improve yield by the credit at low cost and you can investing in exposure-compatible locations. When alongside you can easily advantageous medication out-of studies enterprises, we believe this choice deserves planning by You insurance vendors.

During the periods of markets stress, insurance companies are typically maybe not obligated to feel providers, which provides assistance to help you money locations, the home loan plifies insurance coverage-team funding in the home mortgage business as insurance vendors are needed to overcollateralize their enhances, otherwise financing, from FHLBanks with residential mortgage-relevant financial investments

The fresh FHLBanks is local cooperatives regarding mortgage lenders possessed and governed because of the their 6,502 people, including commercial banking institutions, deals and loan organizations/thrifts, credit unions, community creativity loan providers, and insurance agencies. One organization appointed as a loan company within the Federal Family Mortgage Financial Act out-of 1932 that’s within the good economic standing, and this possess otherwise things mortgage loans or mortgage-supported securities, is eligible to possess membership. 2 Insurance firms, more especially, must be chartered of the and controlled beneath the legislation out-of a good county.

Insurance companies was basically qualified to receive FHLB subscription due to the fact FHLB body’s first, which is evidence of their strengths for the housing industry and you will into the FHLB mission to help you give reliable liquidity so you’re able to affiliate establishments to help with housing loans and you can neighborhood financial support. step 3 Now, around You$step 1.2 trillion, otherwise 15% out of insurers’ spent possessions, try allocated to home-based mortgage-relevant expenditures. 4 Insurance agencies, owing to these financial investments, is actually liquidity company on the home loan-supported securities (MBS) industry, which builds economy getting personal home owners. Just create insurance firms hold home loan-relevant assets, they are largely in a position to keep those assets across the long-term. The brand new FHLB progress system are, within our evaluate, an important unit in-service away from FHLBanks’ dedication to support construction money and people advancement.

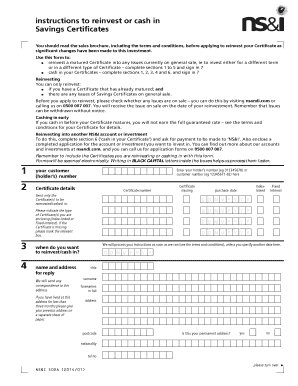

Immediately after enterprises possess fulfilled the fresh registration conditions, they could submit an application for a guaranteed loan, known as a keen advance by the FHLBanks

Directly so when a complete, FHLBanks try liquidity company; it increase glamorous resource in order to representative businesses exactly who therefore offer fund so you can homeowners. Government support additionally the undeniable fact that each financial was in control not only for its debt however, regarding the financial for the the system are what let the FHLBanks to pass through into the cost discounts so you’re able to members.

Becoming a part, an establishment must: (1) see a minimum carrying endurance to own residential MBS; (2) pick FHLB inventory; and (3) fulfill specific borrowing from the bank-get metrics of your own FHLBanks. Registration are removed and was able within carrying-business height. The region in which an insurance carrier conducts their dominating span of company (e.grams., the spot of one’s panel otherwise administrator party) generally decides you to definitely business’s local or home FHLBank. The amount of FHLB inventory necessary to be purchased may differ around the FHLBanks, but usually is actually half the normal commission out-of an insurer’s spent property. FHLB stock is not publicly traded but could be used for level at providing lender not as much as for each and every bank’s conditions.