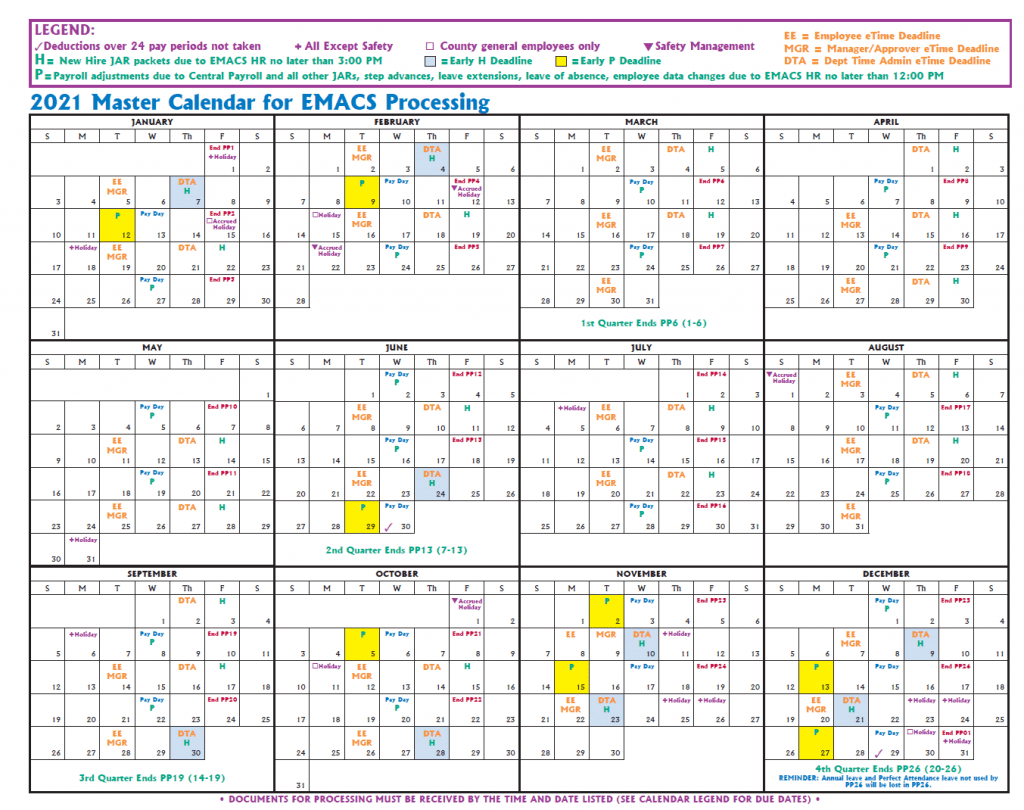

Here is what the price dysfunction looks such as having good USDA Limited recovery financing having an effective $three hundred,000 home with a great $35,000 reple assumes on that the utilities was aroused in the period of the appraisal.

USDA Restricted example

Now let us look at a prospective malfunction to own a USDA Basic restoration mortgage where debtor was recognized having $250,000 and that is purchasing a property getting $200,000.

Within this analogy, we’re going to suppose the latest utilities are not aroused at that time of your own appraisal, so the contingency matter could be 15% of one’s restoration money.

USDA Basic analogy

A good USDA fixer-higher financing provides the same core work with while the a good USDA purchase loan: 100% financing to own just one-family home. Nevertheless obtain the extra from funding 100% of the restoration can cost you also. This means, you can purchase and you will redesign having an individual financing, most of the at the little or no currency off.

Including, if for example the home’s really worth after renovations is more than everything you owe in your home loan, you may have instantaneous equity on the property.

- Our home have to be for the a good USDA-qualified rural otherwise residential district area

- You must meet with the earnings restrictions toward city in which you want buying

- Credit score out of 620 or higher (in the event loan providers may be able to approve your which have a diminished get whenever you are if you don’t creditworthy)

- A being qualified financial obligation-to-earnings proportion* determined by USDA’s Guaranteed Automatic Underwriting

As with a USDA pick loan, USDA renovation fund wanted an appraisal, and this your own bank will order when you go less than package for the a property. You will must find a specialist and you may discover a beneficial specialized bid, otherwise a quote like the extent away from works and related can cost you, and offer https://paydayloanalabama.com/vernon/ one to to the financial.

A fast mention to your USDA income limitations: Loan providers look at the home money without welcome write-offs to decide their USDA eligibility. Regardless of if your revenue is apparently greater than new restrictions to suit your town, you may still meet the requirements immediately following write-offs is pulled.

That is why it’s always a good idea to communicate with a beneficial USDA bank as opposed to guessing at the qualifications your self. If you’re not USDA qualified, their lender will highlight which other loan programs could possibly get performs for you.

There are a number of no and you may low down fee loan alternatives, along with your bank makes it possible to find the right one to.

To find a good fixer-top that have good USDA loan: The way it operates

Some of the measures involved in to invest in good fixer-upper having an effective USDA restoration mortgage resemble those individuals you might proceed through having an effective USDA get mortgage. But there are accessories, specifically while the restoration really works begins.

Step one: Score preapproved

This should be pick regardless of the particular home loan you aspire to rating. Your preapproval page will say to you just how much you could potentially use plus the kind of money your be eligible for. Even as we in the list above, your own maximum preapproval matter is how much you could obtain full, such as the cost and you can renovation costs.

Step two: Generate an offer on a home

Make sure your real estate agent knows that you want to fool around with good USDA loan order your domestic. That way they are able to direct you land that will be in USDA-qualified elements simply.

Step 3: Look for a specialist and you may schedule the assessment

Shortly after the promote was acknowledged, their financial will begin operating your loan and you can you desire to acquire a builder add a restoration bid to the lender. You simply can’t perform some home improvements on your own having good USDA renovation mortgage, thus look forever contractors close by right as you decide on one among them finance.