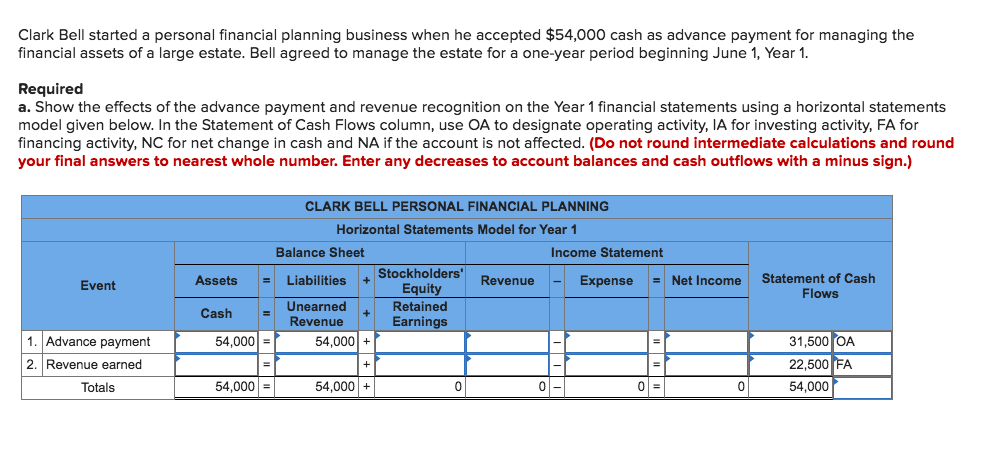

Put to own basic home buyers

Very head financial lenders will accept 10% put for brand new makes and you will 20% deposit to possess present services. While the an initial household visitors you are able to your own KiwiSaver, provided you have been from the plan for at least three years. You could be eligible for the initial Family Give.

You may be fortunate and have now mothers who are able to present otherwise lend you currency to view your first house. However, remember that in the event your cash is that loan the fresh bank will take brand new money under consideration when figuring your income.

When you yourself have below 20% and want to pick a current assets you will be able to track down financing beneath the Basic Mortgage strategy, for people who meet the requirements. Otherwise you can still be eligible for a home loan which have an effective bank otherwise non-bank financial, according to the latest credit plan.

At the time of creating ANZ Financial have revealed one to they’ve got unwrapped the floodgates getting present website subscribers that have below 20% put. Communicate with united states from the whether you may get a reduced guarantee financing.

Second homebuyers

Due to the fact above, really main bank lenders encourage 10% deposit for brand new makes and you will 20% deposit getting current features. ANZ Lender is acknowledging most recent consumer programs that have lower than 20%. You can make use of brand new continues of your own income of the most recent domestic on put, or you can get a bridging mortgage to purchase your next home before selling your existing one to. Therefore you would make use of the guarantee on your latest domestic to obtain the connecting mortgage.

Put to own money spent customers

Really head bank lenders allows a great 10% deposit to possess investment property the generates; whereas you usually you prefer at least forty% put to invest in people founded possessions because the an investment.

Particular non-lender lenders will assist an individual that have lower than 20% put for a new build investment property, but the difference’ in deposit must be constructed thru good additional loan (which the financial can arrange due to the fact another type of financing). This could be taken into consideration to own upkeep purposes. In order to qualify not as much as these situations, the fresh create would need to have the term and code regarding compliance certification issued and get settled inside 90 days following loan acceptance.

Just how much money do you wish to score home financing?

The clear answer needless to say depends on how much cash you will be credit. To obtain an idea, below are a few all of our financial calculator. Enter the amount your seeking to obtain, put the period so you’re able to thirty years together with interest rate in the 7%. This is the calculate several months and you can speed financial institutions examine your value from the. Note but not one particular finance companies wanted a twenty five 12 months identity for investment features. That point they will certainly have fun with in addition to hinges on how many performing ages you have got remaining to settle your own mortgage.

This new calculator will tell you exacltly what the repayments would-be. In case the earnings doesn’t perfectly fulfill the bank’s requirements, cannot panic. Non-lender loan providers enjoys yet another standards and will tend to complement individuals that the financial institutions refuse.

Be aware that people personal debt you have got is taken towards membership in the event the lender works out your revenue. They will along with make data toward expectation that your particular borrowing from the bank credit and you will overdraft constraints would-be maxed away. They will not take into account whether or not you don’t use the overdraft or you pay-off the bank card every month. Because of this, lose down your own charge card and overdrafts constraints to possible. Otherwise top, terminate them downright! While concerned with your debt, have a look at our very own blog toward bringing a mortgage when you really have debt.

For those that is actually notice-functioning, part of the banking institutions will generally require no less than 2 yrs out of confirmed earnings. It means 2 yrs off accountant financials and you may IR tax explanations. If you’ve been operating for under a couple of years, provides a browse of our own writings getting a mortgage in the event that mind-employed for less than 2 yrs.

How come my credit rating impression my personal home loan application?

It all depends towards the bank. Financial institutions try relatively conventional with respect to assessing an enthusiastic applicant’s qualifications predicated on their credit history. Non-lender loan providers be much more flexible and you may chance open-minded, nonetheless they carry out fees highest rates thus. See our very own stuff taking a home loan that have less than perfect credit and getting a home loan after becoming discharged away from bankruptcy.

Just how do my personal investing patterns apply to my mortgage app?

This topic are a growing you to. Brand new present Borrowing Contracts and you can Individual Money Operate (CCCFA) has made banks more old-fashioned inside their means.

Previously, banking institutions grabbed this new simple glance at that people perform change the paying activities when they got a mortgage. So that they weren’t also worried about your own investing; unless of course they searched that expenses are uncontrollable (internet explorer starting overdraft each day). It today want 3 months from bank statements you to prove your newest expenses habits will allow on the home loan repayments.

In order to satisfy this criteria, use our very own mortgage calculator to determine the estimate fortnightly mortgage installment could be, upcoming without any rent you have to pay. The new contour you’re leftover which have is when far you should conserve per two weeks across the three month months. These types of savings may be the evidence that your particular paying activities can match this new repayments.

During the time of writing () of several regarding the home loan business try lobbying with the CCCFA to become clarified to allow financial institutions becoming shorter risk adverse. For the time being, non-lender loan providers provides stayed so much more flexible within approach so will getting recommended for some.

The requested transform otherwise standing towards the home loan credit conditions was anticipated to minimise or perhaps reduce the unintended negative effects throughout the this new CCCFA laws.

The standard of all the details at your home loans Baileyton loan application issues

What the results are if not provide the proper paperwork to show the significantly more than? At the best you’ll have to wade backwards and forwards on lender, at worst they might refuse your downright. And here a mortgage broker contributes loads of value, i would the applying way to be certain that you happen to be putting your very best foot send when making an application for financing. If you are looking to order a home or restructure a recent mortgage, link and we’ll help you get arranged.