Navigating the network out of records and monetary hoops yourself purchasing procedure can be challenging and you may intimidating. Yet ,, getting potential home buyers in Fl, there clearly was a gold liner: USDA finance give a pathway so you’re able to homeownership with minimal downpayment criteria.

This program are specifically made for those with modest income traditions into the rural section. Having said that, its perfect for those who are eyeing house on borders off large Fl metropolises, in which reasonable houses is far more readily available. Geared towards help rural residents, USDA financing inside Fl try a-game-changer to have latest grads, the new family members, individuals generating average earnings, first-date buyers, secluded workers, plus those who have handled borrowing challenges from the past.

What is actually an effective USDA Loan?

USDA rural innovation loans for the Fl are created to give homeownership about faster densely inhabited countries regarding state. USDA funds is going to be a great deal for people, providing reasonable otherwise zero downpayment conditions and you will very competitive interest levels. Borrowers may even sign up for a good USDA design mortgage when you look at the Florida when they like to build a property than just purchase a preexisting assets.

Although not, to be eligible for one money, you need to satisfy particular particular requirements. Instance, you should comply with earnings constraints, which can differ based on the spot where the house is discover. While doing so, the house itself should see USDA standards, definition it is from inside the a medication rural urban area therefore the property is within good shape.

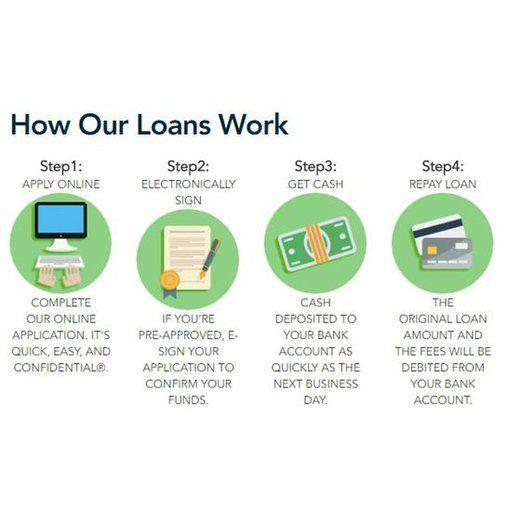

When you find yourself contemplating delivering good USDA mortgage in Florida, here is how while making you to definitely happens: Your apply owing to a loan provider authorized by the USDA. They’re going to evaluate your revenue, credit rating, and a few whatever else to find out if your be considered. If one makes the latest slash, the brand new USDA jumps into make sure the main loan, easing the fresh new lender’s fears and you may allowing them to bring greatest terms so you can consumers.

Overall, USDA outlying advancement financing into the Fl open up gates to own prospective consumers to have a home for the outlying components instead of against significant financial hurdles.

USDA Loan Standards from inside the Florida

While interested in USDA financing conditions inside the Florida, it is good to discover what is requested. Straight away, there are lots of first conditions you should see:

- Citizenship: You really must be a U.S. resident or permanent resident with a stable earnings and you may a willingness to blow back the mortgage.

- Income limits: Borrowers need to stay into the income limitations set of the USDA, and this vary based on how big the household are and you will where he’s thinking of buying.

- Place : The property must be within the an outlying city that is authorized by the USDA. You can check out the USDA qualification chart so you’re able to get a hold of areas where you can buy a property using a good USDA mortgage.

- Lender’s legislation: On top of the general statutes, loan providers have even more standards particularly at least credit history or facts you to individuals have sufficient bucks to pay https://clickcashadvance.com/personal-loans-fl/ for closing costs. These types of rules make sure you are economically happy to deal with the brand new financing that assist convenience the new lender’s fears .

When you’re thinking about taking a USDA loan when you look at the Fl, it is smart to talk to a loan provider approved by the USDA to enable them to take you step-by-step through all of the inches and you may outs and figure out while you are a great fit to possess the borrowed funds.

Positives and negatives out-of USDA Funds

Regarding deciding and that mortgage is perfect for you, there are a few pros and cons off USDA loans so you can thought.

- Zero downpayment: USDA funds enable it to be consumers to find a house without currency off . This entry to facilitates homeownership, especially for people who find themselves looking to buy a house with lower income , every if you find yourself nonetheless permitting these to allocate finance into the most other home-relevant costs.

- Aggressive interest rates: Backed by the government, USDA fund provide lenders faster risk, converting to the relatively low interest for consumers.

- Streamline USDA refinance: The USDA has a streamline refinance system which allows to have existing USDA fund to be refinanced to a reduced speed (in the event the offered) without the income, appraisal, otherwise borrowing from the bank criteria. Particular constraints would incorporate however for the absolute most area its a fairly simple strategy to reduce your speed for as long as you aren’t seeking any cash-aside.

- Versatile borrowing criteria: USDA loans routinely have so much more forgiving credit history standards versus old-fashioned money, accommodating individuals which have smaller-than-primary credit histories. In the Griffin Money, we can focus on individuals that have Credit ratings just like the reduced because the 600.

- No PMI: In the place of conventional financing, USDA finance do not mandate private mortgage insurance coverage, potentially ultimately causing straight down monthly mortgage payments to have individuals.