Building a robust Borrowing Profile

Development a strong borrowing character that meets the latest acceptance off financial lenders is similar to constructing an enthusiastic impenetrable stronghold. The foundation is put with just minimal access to the readily available credit, in which saving cash than simply 30% of your total restrict is preferred. Typical, on-big date payments Bolster it financial bastion because of the showing future loan providers their dedication to financial precision.

Through its proper borrowing from the bank usage comes to keeping balance-avoiding excess unlock accounts while you are featuring ace handling of present of these. This method illustrations out a great portrait highlighting one’s aptitude for handling debt burden and you can aligns harmoniously to your track starred by the individuals granting home loan approvals.

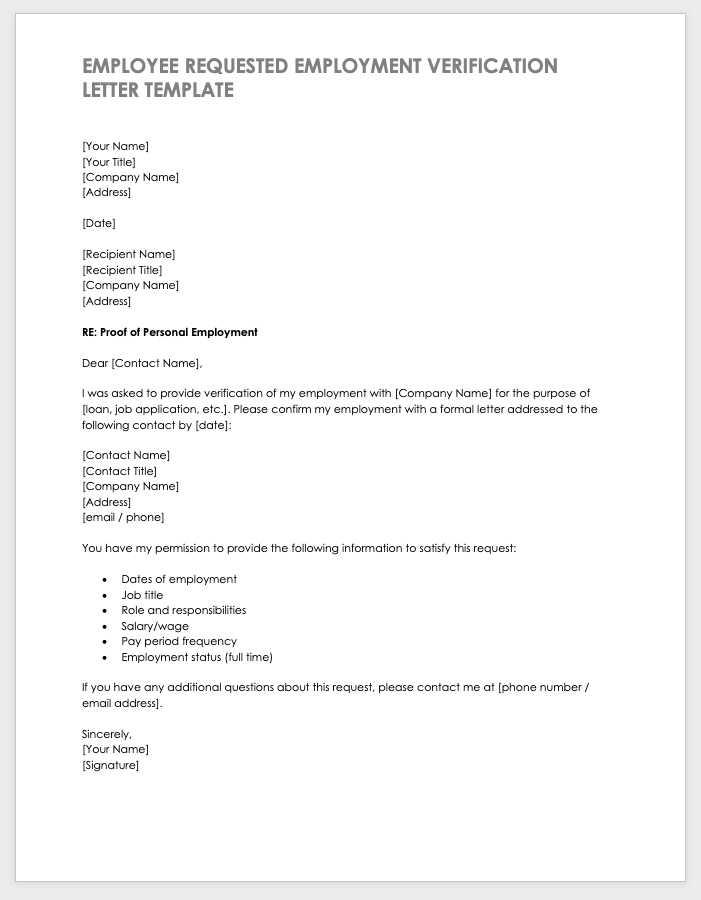

Organizing Financial Data files

Loan providers scrutinize your financial record having great detail, it is therefore important to present an organized line of your fiscal files. Sorting away taxation facts, spend stubs, and bank comments is actually similar to plotting a straightforward direction for mortgage officials to help you navigate. A proper-ordered demonstration streamlines the latest pre-certification and you will pre-approval grade if you are exhibiting your commitment to controlling economic matters.

Consistently upgrading which databases of information is an essential lingering task. For each and every upgrade serves instance a guiding light into a powerful loan software process. Are prepared will be the the answer to gliding easily on pre-recognition instead of languishing on the preliminary pre-certification stage on account of avoidable keep-ups.

Realization

While we moor just after all of our voyage through the areas from pre-qualification and you may pre-recognition, i think about the fresh new rich tapestry of real information we now have woven. Information these procedures is all about parsing conditions and strategizing your way to homeownership. Pre-degree offers an easy glimpse in the financial potential, when you’re pre-approval provides a powerful, noted commitment that may build all the difference inside competitive seas.

If or not you choose the fresh new swift currents out-of pre-qualification or the a lot more deliberate trip away from pre-recognition, just remember that , your way can be essential as the interest. The brand new proper care you consume preparing your financial story in addition to foresight to help you navigate borrowing solutions often lay the course for an excellent profitable homebuying feel. Could possibly get the gusts of wind away from economic wisdom be at the straight back.

Faqs

Pre-qualification is a quick assessment using standard investigation and you may a card take a look at provide a projected assessment. In contrast, pre-recognition pertains to a call at-breadth application techniques with outlined records leading to a great conditional union.

How quickly should i get pre-certified otherwise pre-acknowledged?

Obtaining pre-qualification is generally a swift techniques, often finished inside an hour or so. Although not, the method for securing pre-acceptance you will expand around ten working days whilst demands total recommendations and you may documents.

What data files am i going to dependence on pre-approval?

To get pre-approval, you ought to provide installment tribal loans no credit check no teletrack total financial recommendations, together with your W-2 statements, family savings info, and tax returns. This can be with the very first money investigation and you can credit examine needed for pre-degree.

The fresh offered data allow lenders to test your financial situations accurately and you can figure out the borrowed funds count youre qualified to receive.

Is pre-degree otherwise pre-approval most useful to have an initial-day homebuyer?

It was informed you to definitely earliest-big date homeowners initiate the travel because of the seeking to pre-qualification, that processes approximates just how much one can possibly use and does thus without demanding a great deal of files, ergo serving while the a good first faltering step from the pursuit of homeownership.

Ought i get pre-recognized if I’m to order when you look at the an aggressive industry?

From inside the a competitive market, protecting pre-recognition is important as it shows your financial accuracy and you can seriousness given that a buyer, possibly giving your a plus more than almost every other competitors.

A realtor may help navigate competitive places from the making certain you’ve got an excellent pre-acceptance letter, which not just reveals evidence of capital plus facilitate new agent know their price range and you can show you so you can appropriate posts.