How can you go about opting for an investment mortgage that will not end causing you monetary soreness? A property credit pro throws inside their a few cents’ really worth in the how to pick the best loan to you personally, and the secret issues to inquire about your lender.

Committing to property would be a worthwhile promotion, however it need extreme money, and if you are given committing to home, acquiring an investment mortgage also provide the capital you should start-off.

not, choosing the right financing to suit your investment property produces all the the real difference with respect to building a successful assets portfolio.

To find a second house is a little dissimilar to buying your first, just like the you will find a great deal more to think about with respect to your own means and you may expectations, states Bankwest Standard Manager – Home buying, Peter Bouhlas.

With many financing possibilities, it could be daunting knowing how to proceed however, Peter says starting the foundation knowing your current financial situation is actually a good set.

Whether it’s the first investment property or you’re looking to incorporate into the collection, they are inquiries to inquire about your lender to help you find that loan this is the proper complement your financial wants.

Exactly what are the newest rates?

The pace have a tendency to impact the complete count you repay more than the life span of your own mortgage, and it may rather feeling your own success.

Rates of interest to possess capital finance are generally greater than the individuals to possess owner-filled finance, however they may differ notably ranging from lenders, so it’s necessary to compare rates of interest and you may research rates to own an educated contract.

Those looking to put money into accommodations assets could find economic advantages within the performing this, but there are lots of you should make sure, like what section has high tenant request, https://simplycashadvance.net/title-loans-al/ as well as the other interest levels readily available for traders than the holder-occupiers, Peter states.

When you yourself have numerous loans otherwise qualities, it will be worthwhile calling your own financial or agent, who’ll let explain the processes and provide you with an idea out-of exactly what your earnings may look instance shortly after.

Exactly what financing choices are available?

Variable-rates fund are interested rate which can change over go out, while repaired-rate fund enjoys an appartment rate of interest for a certain months.

Every type of mortgage has its own benefits and drawbacks. Variable-price funds also provide autonomy and lower initially will cost you, if you are repaired-rate finance provide safety and confidence in terms of repayments.

For these given restoring, Bankwest’s Fixed Price Mortgage gets the certainty regarding being aware what the interest rate and you will payments will be, Peter demonstrates to you.

Home owners can pick their fixed price period from a single to help you four age, and you can installment volume, getting you to definitely per week, fortnightly otherwise monthly, which can help anyone manage its finances.

Before your fix, Peter states its worth taking into consideration the latest effects if you split the loan within the repaired months, since the split costs you are going to pertain.

Exactly what are the financing terms featuring?

Some other lenders provide other financing has that apply at their loan’s independency and you will total cost, such offset accounts, redraw business, separated financing and portability (which is the power to transfer the loan to some other assets if you decide to promote a financial investment).

In reducing your home mortgage desire, you might want to hook up an offset membership towards home loan or perhaps capable of making more payments, Peter says.

Otherwise, which will make managing your bank account and budgeting easier, you may want a great deal more versatile repayment alternatives, the choice to split the loan ranging from repaired and adjustable, or to combine your financial situation into your home loan.

While you are refinancing to some other financial, you could also meet the requirements in order to allege cashback also offers, that could assist to counterbalance any additional fees otherwise mortgage place costs.

Which are the repayment alternatives?

An interest-merely mortgage would be an appealing choice for property investors while the it permits for down repayments in appeal-just months.

This can provide earnings getting people for most other financial investments or even to safeguards possessions expenditures such repairs or renovations.

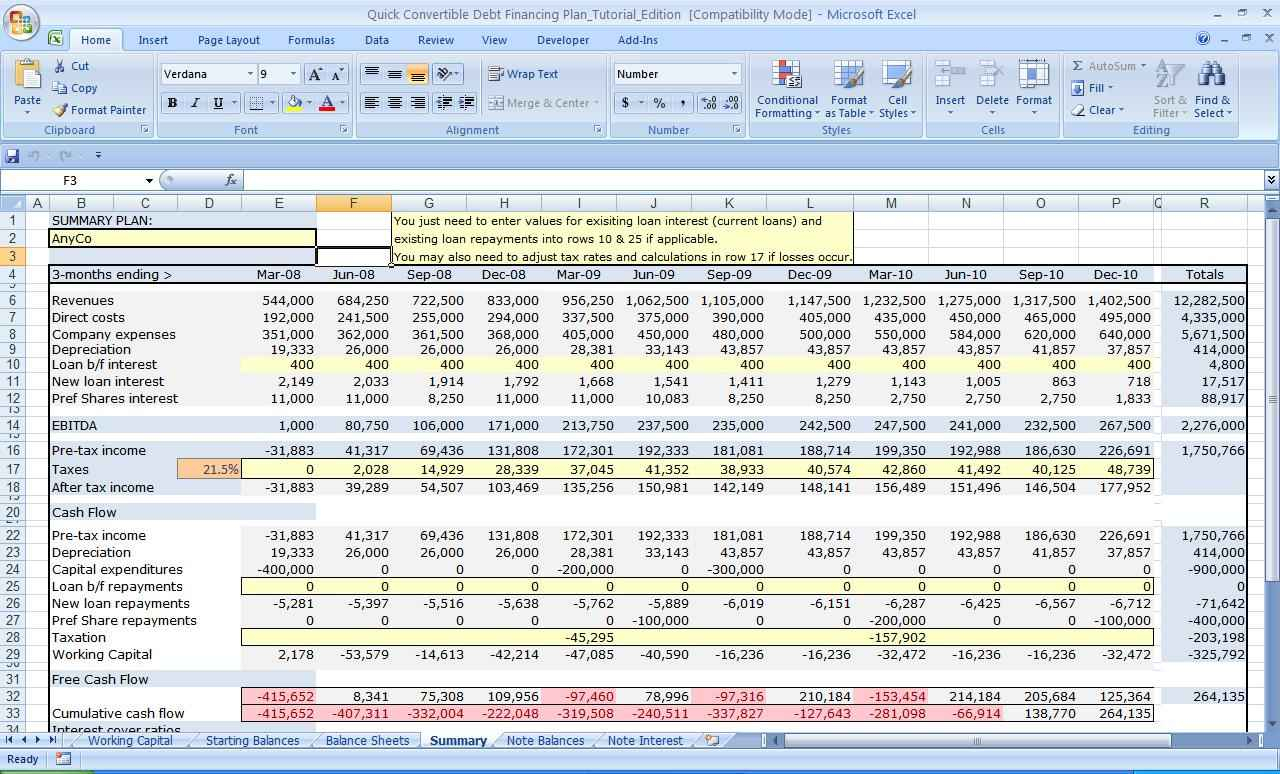

This new repayment option you choose gets a lot to would with your complete policy for your investment assets. Picture: Getty

This may trigger higher complete desire costs over the lifestyle of mortgage, although the 1st money was lower.

What other will set you back ought i think?

You should learn about the newest upfront will set you back that include purchasing a residential property just like the factoring when you look at the will set you back outside of the put – including bodies fees – helps you end offending unexpected situations.

It is a state or region authorities income tax which is energized to have legal files as stamped. The new statutes to your stamp responsibility are always susceptible to transform, so it’s best if you check your county otherwise territory government’s houses site for the most current suggestions.

Peter says the individuals considering to purchase a different sort of property keeps book factors, eg leverage brand new collateral in their current profile and refinancing the established loans.